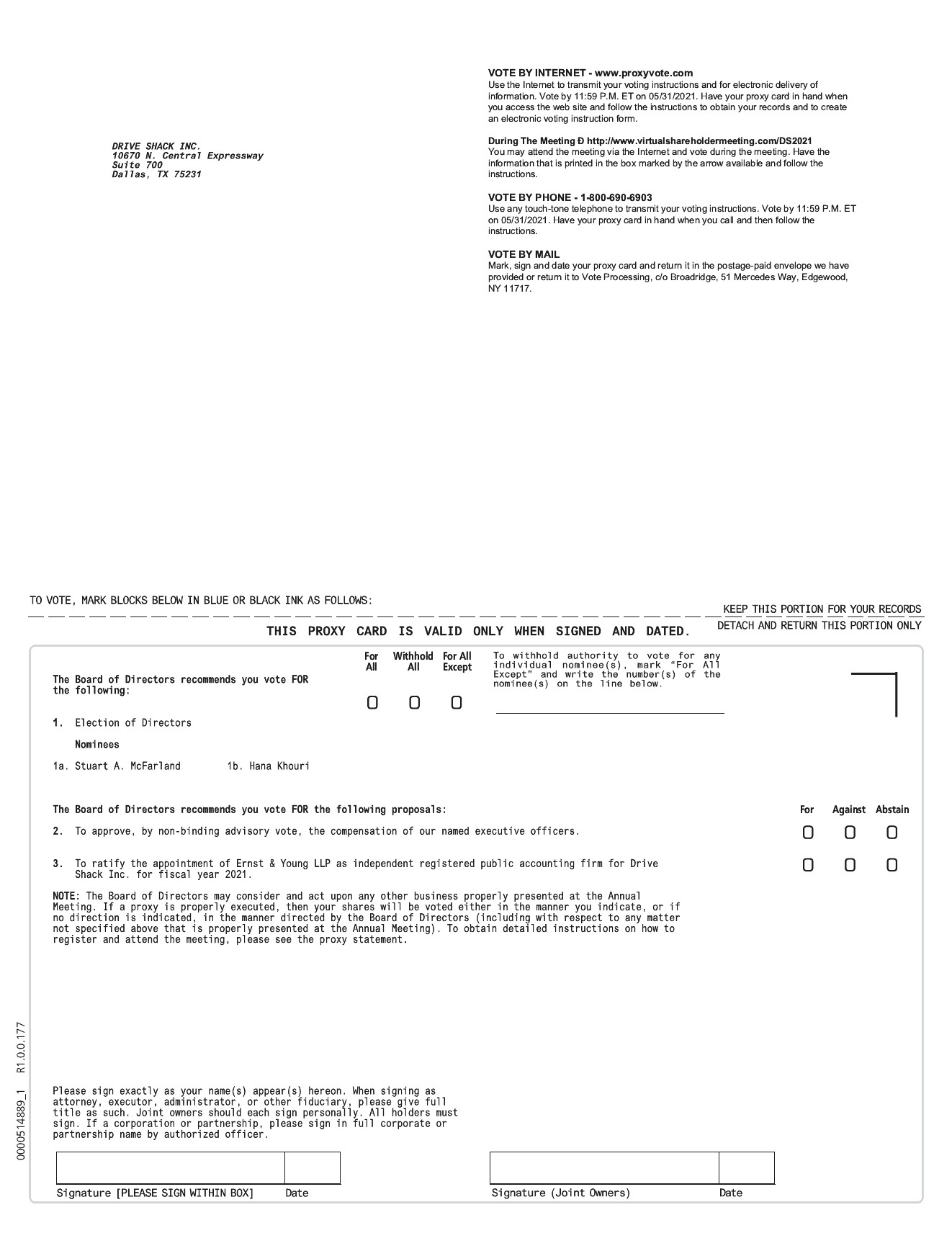

GENERAL INFORMATION ABOUT VOTING

The enclosed proxy is solicited by and on behalf of our Board of Directors. The expense of preparing, printing and mailing this Proxy Statement and the proxies solicited hereby will be borne by the company. In addition to the use of the mail, proxies may be solicited by officers and directors, without additional remuneration, by personal interview, telephone or otherwise. The company will also request brokerage firms, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares held of record as of the close of business on April 12, 2021, and will provide reimbursement for the cost of forwarding the material.

Stockholders Entitled to Vote

As of April 12, 2021, there were outstanding and entitled to vote 92,027,806 shares of our common stock. Each share of our common stock entitles the holder to one vote. Stockholders of record at the close of business on April 12, 2021 are entitled to vote at the Annual Meeting or any adjournment or postponement thereof.

We also have outstanding 1,347,321 shares of our 9.75% Series B Cumulative Redeemable Preferred Stock, 496,000 shares of our 8.05% Series C Cumulative Redeemable Preferred Stock and 620,000 shares of our 8.375% Series D Cumulative Redeemable Preferred Stock. These shares have no voting rights, except in limited circumstances, none of which are applicable to the matters that will be presented for consideration at the Annual Meeting.

Stockholder of Record. If your shares are registered directly in your name with the company’s transfer agent, American Stock Transfer & Trust Company LLC, you are considered the stockholder of record with respect to those shares, and these proxy materials were sent directly to you by the company.

Street Name Holders. If your shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are the beneficial owner of shares held in “street name,” and these proxy materials will be or have been forwarded to you by your bank or broker. The bank or broker holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to instruct your bank or broker on how to vote the shares held in your account. If you wish to attend and vote your shares during the virtual Annual Meeting, you will need to obtain a “legal proxy” from your bank or broker.

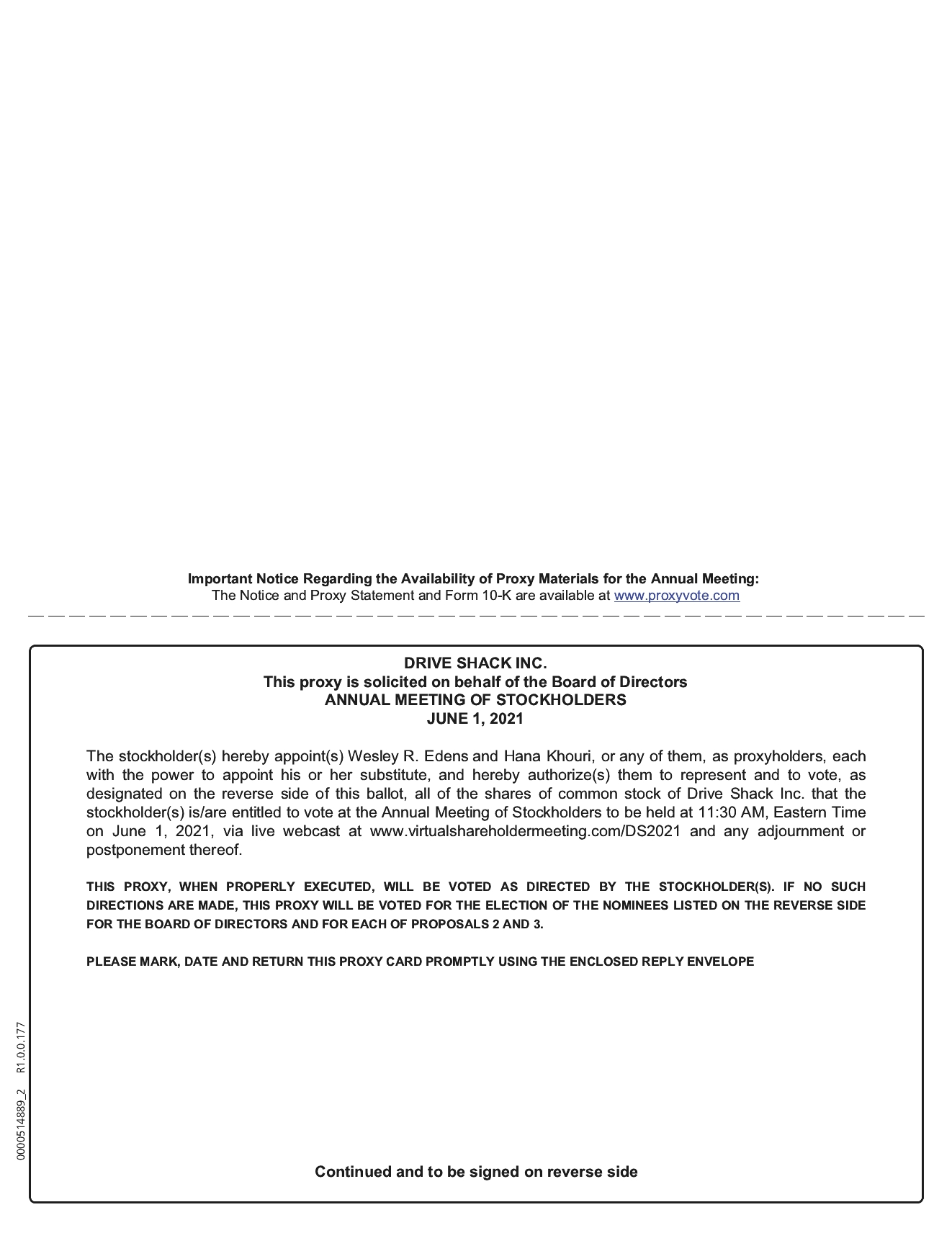

Attending the Virtual Annual Meeting

You may attend the virtual Annual Meeting, as well as vote and submit questions online during the Annual Meeting, by visiting http://www.virtualshareholdermeeting.com/DS2021. You will need your unique control number, which appears in the proxy card or voting instruction form that accompanied the proxy materials. In the event that you do not have a control number, please contact your bank or broker as soon as possible so that you can be provided with a control number and gain access to the meeting.

A quorum will be present if the holders of a majority of the outstanding shares entitled to vote are present, in person or by proxy, at the Annual Meeting. If you have returned a valid proxy or if you hold your shares in your own name as holder of record and attend the virtual Annual Meeting, your shares will be counted as present for the purpose of determining whether there is a quorum. Votes to “withhold,” abstentions and “broker non-votes” (as described below) will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum.

If a quorum is not present, the Annual Meeting may be adjourned by the chairman of the meeting or by the vote of a majority of the shares represented at the Annual Meeting until a quorum has been obtained.

For the election of the nominees to our Board of Directors (Proposal 1), the affirmative vote of a plurality of all the votes cast at the Annual Meeting is sufficient to elect the nominee if a quorum is present, meaning each nominee will be elected if he or she receives at least one “for” vote. The affirmative vote of a majority of the votes cast by holders of our common stock at the Annual Meeting is required to approve, on a non-binding, advisory basis, the “say-on-pay” proposal (Proposal 2) and to ratify the appointment of Ernst & Young LLP as the company’s independent registered public accounting firm for the fiscal year ending December 31, 2021 (Proposal 3).