Exhibit 1.1

DRIVE SHACK INC.

10670 N. Central Expressway

Suite 700

Dallas, TX 75231

July 12, 2021

Symphony Ventures

51 Dawson Street

Dublin 2 D02 TR53

Ireland

ATTN: Donal Casey

Letter Agreement

Dear Partners of Symphony Ventures:

In appreciation of your continued interest in partnering with us, this letter agreement sets forth the proposed terms for the co-investment (the “Investment

Transactions”) between Drive Shack Inc., a Maryland corporation (“Drive Shack”), and Symphony Ventures, a partnership organized under the laws of Ireland (the “Partner Investor” or “Symphony”), in Drive Shack’s newest

business line, the Puttery.

We believe we share a passion to develop a novel, golf-oriented business that provides a measure of excitement to anyone that walks in the door, and

we cannot think of a better partner than Symphony.

As you know, our plan is to develop, construct and open between 35 and 40 venues over the following three-year development schedule (the “Development

Schedule”):

| • |

7 Puttery venues in 2021 (including in Dallas, TX, Charlotte, NC, Washington, DC and Miami, FL);

|

| • |

10 Puttery venues in 2022; and

|

| • |

20 Puttery venues in 2023.

|

Subject to market conditions and geographic factors, we intend the cost-to-build a Puttery will range between $6 million and $8 million,

anticipating that the cost-to-build for earlier venues will exceed that of later venues.

|

1.

|

Investment Terms

|

|

Development

Phase

|

Drive Shack will be responsible for the development and construction of each Puttery venue. During the development phase, we will organize the assets of each

Puttery venue in a specially designated Delaware limited partnership (each, an “Operating Partnership”).

Initially, Drive Shack will own 100% of the partnership interests in each Operating Partnership through a wholly owned subsidiary (the “DS Investor”

and, together with Symphony, the “Investors”).

|

|

Investment

Structure

|

Drive Shack will notify Symphony approximately 30 days prior to the receipt of the certificate of occupancy for each Puttery venue.

No later than the fifth business day (the “Closing Date”) following (1) written notice by Drive Shack to Symphony of the receipt of the certificate of

occupancy for a Puttery venue and (2) delivery by Drive Shack to Symphony of a written line item summary in reasonable detail, of the total cost-to-build of such Puttery venue, Symphony will invest an amount in cash equal to 10% of the

total cost-to-build of such Puttery venue in exchange for newly issued partnership interests representing 10% (the “Ownership Percentage”) of the outstanding partnership interests of the Operating Partnership (the “Partner

Interests”) that owns such Puttery venue (each, a “Co-Investment); provided however that Symphony shall not be required to invest an amount in cash equal to more than $1 million in any single Puttery venue (in exchange for a

proportionate share of equity) without its prior written consent (calculated exclusive of investments made pursuant to Upsize Options) (“Single Venue Co-Investment Cap”). The Partner Interests held by Symphony will be pari passu in all respects with the Partner Interests held by the DS Investor in such Operating Partnership, in reflection of our mutual shared financial

interests. Immediately following the issuance of the Partner Interests to Symphony, the DS Investor will retain an Ownership Percentage in such Operating Partnership of 90%.

Each Co-Investment will be governed by a limited partnership agreement (each, an “Operating Agreement”) to be executed by the Investors substantially

concurrently with the closing thereof. A draft of such Operating Agreement will be provided to Symphony at least 30 days prior to each such closing.

|

|

Committed

Amount

|

Until the earlier of the termination of this letter agreement or the expiration of the three year duration of the Development Schedule (the “Commitment Period”) and subject to the Single Venue

Co-Investment Cap, Symphony will finance a Co-Investment alongside Drive Shack’s 90% investment in each successive Puttery venue that Drive Shack opens pursuant to the Development Schedule until it has invested an aggregate amount of cash

equal to $10 million (calculated exclusive of investments made pursuant to Upsize Options) (the “Commitment”). Following satisfaction of the Commitment, Symphony will have the right, but not the obligation, to finance subsequent

Co-Investments through the duration of the Development Schedule on the terms contemplated herein.

|

|

Upsize Option

|

On or prior to the first anniversary of the Co-Investment in each Operating Partnership, Symphony may elect to increase its Ownership Percentage therein from 10% to 20% (each, an “Upsize Option”), by

investing an additional amount in cash equal to the same amount paid by Symphony for its Partner Interests on the date of such Co-Investment. Symphony will provide written notice at least three business days prior to exercising an Upsize

Option and will pay the cash due upon exercise of the Upsize Option no later than 10 business days following the applicable first anniversary for each Upsize Option exercised by Symphony.

|

|

Distributions

|

Each Operating Partnership will pay a quarterly cash distribution to each Investor in an amount equal to: (1) such Investor’s Ownership Percentage multiplied

by (2) Venue Net Cash Flows (and in any event at least the amount intended to enable each Investor to satisfy its U.S. federal, state and local income tax liabilities in each taxable year).

“Venue Net Cash Flows” will equal, with respect to any quarter, (1) gross revenues generated by the Operating Partnership’s Puttery venue during such

quarter minus (2) direct operating expenses of such Puttery venue, good faith reserves and the Management Fee for such quarter.

|

2

|

|

Distributions of net proceeds of any sale transaction and a winding up of the Operating Partnership, after payment, or good faith reservation for payment, of

liabilities shall be distributed pro rata based on the Investors’ respective Ownership Percentages.

The “Management Fee” will equal $250,000 per annum, payable quarterly by each Operating Partnership to Drive

Shack pursuant to a management agreement, to cover corporate management and support, including human resources, legal and accounting and finance. The Management Fee will include an escalator to account for inflation (pursuant to a formula

to be set forth in the Operating Agreement) and, in cases where market conditions and geographic factors have contributed to a cost-to-build greater than $10 million, the parties will negotiate in good faith a corresponding equitable

increase in the Management Fee.

|

|

Debt Financing

|

We may determine that it would be financially advantageous to us and you to use debt financing to fund construction or improvements of one or more Putteries (“Leverage”), which would reduce both Drive

Shack and Symphony’s cost basis on a proportional basis in accordance with the amount of debt. For example, if debt finances $3 million of a total of $6 million in cost-to-build, Drive Shack and Symphony would contribute $2.7 million and

$300,000, respectively, in equity in exchange for the 90%/10% equity split and the price of Symphony’s Upsize Option would equal $300,000. Venue Net Cash Flows will be applied to service such debt only to the extent proceeds are used at

Putteries in which a Co-Investment is made (and not, for the avoidance of doubt, to service or repay, or be used to guarantee, indebtedness outside the Puttery Co-Investment). In addition, each Investor will be permitted to fund its

Ownership Percentage by issuing debt at the Investor-level or through an affiliate, so long as such debt is not an obligation of, or guaranteed by, any Puttery except to the extent of such Investor’s pro rata share of Venue Net Cash Flows.

The Investors agree to use their reasonable best efforts to assist in financings, including by cooperating with any pledge or similar collateral requirements of any financing source.

|

|

Anti-Dilution

|

While we do not currently anticipate issuing additional equity in any Puttery following a Co-Investment, in no event will an Investor’s Ownership Percentage be diluted by equity financings or issuances

without all Investors first being offered the opportunity to participate in the offering or issuance on equal terms.

|

|

Optional

Conversion of

Partner

Interests

|

At any time on or after January 1, 2024, at the written request of Symphony, the Investors will cooperate in good faith to enter into a transaction or a series of transactions to effect the conversion at fair

value of all or a portion of the Partner Interests into shares of common stock, par value $0.01 per share, of Drive Shack.

|

|

Transfers;

Other Investors

|

Neither Investor will transfer its Partner Interests without the prior written consent of Drive Shack, except in connection with bona fide estate planning purposes. Symphony shall have a “tag along” right if

the DS Investor shall transfer all or a portion of its Partner Interest in an Operating Partnership in which Symphony holds Partner Interests or if Drive Shack shall transfer its equity interest in the DS Investor in an Operating

Partnership in which Symphony holds Partner Interests. Symphony may determine in its discretion to add additional investment partners to participate in its portion of the Co-Investment during the duration of the Development Schedule, while

agreeing that the current Symphony partners retain majority ownership and control.

|

3

|

Governance

|

The DS Investor will appoint a board of managers of each Operating Partnership, composed of Drive Shack employees, to manage the day-to-day affairs of each

Operating Partnership. Each Operating Agreement shall provide that Symphony representative will be invited to attend a quarterly business update call with the board of managers of such Operating Partnership (including the CEO and/or the

CFO of Drive Shack), in order to review that quarter’s results and discuss the business as a whole.

Each Operating Agreement will disclaim all fiduciary duties to the maximum extent permitted by applicable law and contain customary indemnification and

exculpation provisions for the benefit of managers and officers.

|

|

Tax Status

|

Each Operating Partnership in which the Partner Investor owns Partner Interests shall be taxed as a partnership for US tax law purposes, and the DS Investor and Drive Shack shall not change such tax status of any such Operating Partnership without the consent of Partner Investor. |

|

Information

Rights

|

Each Operating Partnership will provide to the Investors unaudited annual financial statements prepared in accordance with US GAAP and unaudited quarterly financial statements and the Partner Investor shall

have the right to review the books and records (as defined in the Delaware General Corporations Law) of any Operating Partnership in which it holds a Partner Interest upon reasonable notice.

|

|

Closing

Covenants

|

The Investors will use reasonable best efforts to take all actions necessary, proper or advisable under applicable law to consummate the Investment Transactions, including obtaining such authorizations as may

be necessary to execute the Operating Agreement and such consents, approvals, permits or authorizations as governmental entities and third parties may require (collectively, the “Required Approvals”).

|

|

Representations

and Warranties

|

Each Operating Agreement will include customary representations and warranties (including investment representations and warranties of the Partner Investor).

|

|

Conditions to

Closing

|

The closing (each, a “Closing”) of each Investment Transaction will be subject to the satisfaction or waiver of customary conditions on the Closing Date of such Transaction, including the following:

|

|

• Required Approvals. The Required Approvals shall have been obtained.

• No Injunctions or Restraints. The consummation of the Investment Transaction shall not violate, or be prohibited or otherwise rendered unlawful by, any order, decree, ruling, injunction or other action

of any United States governmental entity or law or regulation of the United States.

• Representations and Warranties. The representations and warranties of the Investors set forth in the Operating Agreement shall be true and correct as of the Closing, subject to customary qualifications

for materiality and material adverse effect on the Investors’ respective abilities to consummate the Investment Transaction.

|

4

|

• Performance of Obligations. The Investors shall have complied in all material respects with their obligations under the applicable Operating Agreement (including those described under Investment Structure above).

• Execution of Agreements. The Investors shall have delivered counterparts to the Operating Agreement and all ancillary agreements in respect of such Investment Transaction.

In the event any Closing does not occur on or before the date that is 15 days (as extended pursuant to the immediately following sentence) after the receipt of

certificate of occupancy (each, an “Outside Date”), either Investor may terminate the Investment Transaction, unless at such time such Investor has breached any representation, warranty, covenant or other agreement that has or would

result in the failure of a condition to the applicable Closing. If either Investor has breached any representation, warranty, covenant or other agreement that has or would result in the failure of a condition to the applicable Closing, and

such breach is continuing on the applicable Closing Date, such Investor shall use its best efforts to cure such breach within 15 days after the earlier to occur of (1) written notice of such breach by the non-breaching party and (2) the

applicable Closing Date.

|

|

Remedy for

Breach

|

Each Investor will be entitled to specifically enforce the covenants and other agreements of the other Investor contained in each Operating Agreement and to injunctive relief restraining the other Investor

from breaching or threatening to breach such Operating Agreement, in addition to all other remedies available to it under law or equity. Without limiting the generality of the foregoing, if Symphony defaults on its Commitment or any other

representation, warranty, covenant or other agreement set forth in this letter agreement or any Operating Agreement and such default would have a material adverse effect on the Investment Transaction, Symphony shall use its best efforts to

cure such breach within 15 days after written notice of such breach by the DS Investor and, in the event of a failure to cure, (1) the DS Investor may exercise its right of specific performance to cause Symphony to consummate the Commitment

(to the extent then unsatisfied) or terminate the Commitment and (2) Symphony shall not be entitled to exercise any Upsize Option or consummate any further Co-Investments following the satisfaction of its Commitment. Without limiting the

generality of the foregoing, if the DS Investor defaults on any of its representations warranties, covenants or other agreements set forth in this letter agreement or in any Operating Agreement, and such default would have a material

adverse effect on the Investment Transaction, the DS Investor shall use its best efforts to cure such breach within 15 days after written notice of such breach by Symphony and, in the event of a failure to cure, Symphony may terminate this

letter agreement and all of its obligations hereunder, including the Commitment.

|

|

No Survival or

Indemnification

|

The representations and warranties and closing covenants of the Investors in the applicable Operating Agreement will not survive the Closing. There will be no post-Closing indemnification by any Investor,

Drive Shack or their equity holders, except, in the case of Drive Shack, for fraud or construction defects for which Drive Shack has not received an adequate indemnity agreement from its general contractor.

|

|

Governing

Law; Waiver of

Jury Trial

|

Each Operating Agreement will be governed by the laws of the State of Delaware, with venue in the Chancery Court of the State of Delaware, which will have exclusive jurisdiction for all matters relating to

the Investment Transaction and the other transactions contemplated by such Operating Agreement. The Investors will waive any right to a jury trial.

|

5

| 2. |

Conditions.

|

The effectiveness of this letter agreement is subject to the condition that no United States governmental entity shall have issued any order,

decree, ruling, injunction or other action restraining, enjoining or otherwise prohibiting the consummation the transactions contemplated hereby and no law or regulations in the United States shall have been adopted that makes consummation of such

transactions illegal or otherwise prohibited.

| 3. |

Termination.

|

This letter agreement may be terminated by the mutual written agreement of the parties hereto at any time or as set forth in Remedy for Breach above; provided that unless otherwise provided herein, such termination shall not impair or otherwise affect the rights or remedies of the parties under the confidentiality provisions

described in Section 6 or for any prior breach of the obligations set forth in Sections 2 through 9 of this letter agreement.

| 4. |

Representations and Warranties.

|

Each party hereto represents and warrants that (1) this letter agreement has been validly executed and delivered, (2) the execution of this letter

agreement and the performance of the transactions contemplated in Section 1 of this letter agreement will not violate any contract or other agreement applicable to such party and (3) the matters set forth in this letter agreement constitute valid

and binding obligations of such party, enforceable against such party in accordance with its terms.

| 5. |

Expenses.

|

Each party shall pay their own fees, costs and expenses incurred in connection with the negotiation, preparation and execution of this letter

agreement.

| 6. |

Confidentiality.

|

The existence of this letter agreement, its contents and any information provided by either party in connection with this letter agreement shall be

treated by the parties as strictly confidential, and neither party shall disclose the existence or contents hereof to any third party without the prior written consent of the other party, except to the partners, and the legal, accounting and

financial advisers, of the Partner Investor or pursuant to a subpoena or order issued by a court or by a judicial, administrative or legislative body or committee, or in a proceeding relating to a dispute

involving this letter agreement, in each case, having jurisdiction over such party, or as otherwise required by applicable law, including the reporting obligations of the Securities Exchange Act of 1934, or compulsory legal process; provided that

the parties shall cooperate to produce and issue a mutually acceptable press release announcing the entry into this letter agreement and the identity of the Partner Investor to be issued substantially concurrently with such execution thereof and

Drive Shack may file this letter agreement on a Form 8-K with the Securities and Exchange Commission, pursuant to its reporting requirements thereunder. The disclosure by Drive Shack or any affiliate thereof, of the identity of the Partner

Investor or any of its partners shall be approved in advance by the Partner Investor.

6

| 7. |

Non-Competition.

|

During the period of the Development Schedule in which the Partner Investor holds any Partner Interests and for three years thereafter, the Partner

Investor will not, directly or indirectly, (1) invest in, provide advice to or engage in any Competing Business that operates or has plans to operate within 25 miles of any Puttery business or (2) lend or allow the Partner Investor’s name to be

used to support or advertise any Competing Business. “Competing Business” means each of Putt Shack, PopStroke and any other existing or future company whose primary business involves golf-centered entertainment combined with food and

beverage operations in an indoor setting.

| 8. |

Definitive Documentation.

|

Section 1 of this letter agreement does not contain all of the terms and conditions upon which Drive Shack and the Partner Investor would enter into

the Investment Transactions, and such terms and conditions will be set forth in an Operating Agreement acceptable to the Investors for each Investment Transaction (it being understood and agreed that the Investors will execute such Operating

Agreement containing provisions consistent with Section 1 on the applicable Closing Date). Until such Operating Agreement is executed, only the matters set forth in Sections 2 through 9 of this letter agreement, and the Operating Agreement

described in the parenthetical in the immediately preceding sentence, shall constitute binding agreements between Drive Shack and the Partner Investor.

| 9. |

Miscellaneous.

|

This letter agreement shall be governed by and construed in accordance with the laws of the State of Delaware, without giving effect to principles

of conflicts of laws. Venue shall be in the Chancery Court of the State of Delaware, which will have exclusive jurisdiction for all disputes arising out of this letter agreement. The parties agree to waive any right to a jury trial with respect to

all disputes arising out of this letter agreement. This letter agreement may not be modified, changed or discharged, in whole or in part, except by an agreement in writing signed by both parties. For the convenience of the parties, this letter

agreement may be executed by facsimile signature and in counterparts, each of which shall be deemed to be an original, and both of which taken together, shall constitute one agreement binding on both parties.

[Remainder of Page Intentionally Left Blank]

7

We are grateful for the opportunity to partner with you as co-investors in the Puttery. If the foregoing terms express an acceptable transaction for this venture, please

execute this letter agreement in the space provided below.

Very Truly Yours,

|

DRIVE SHACK INC.

|

||

|

By:

|

||

|

Name: Hana Khouri

|

||

|

Title: CEO & President

|

||

|

ACCEPTED AND AGREED AS OF THE DATE FIRST WRITTEN ABOVE:

|

||

|

SYMPHONY VENTURES

|

||

|

By:

|

||

|

Name: Donal Casey

|

||

|

Title: Partner

|

||

[Signature Page to Letter Agreement]

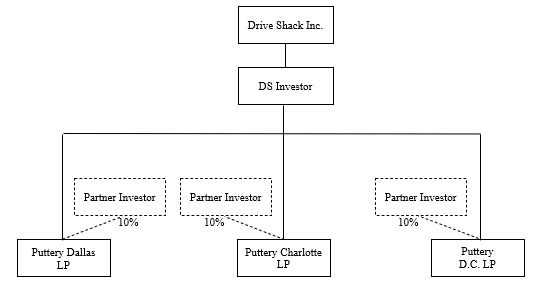

ANNEX A

Puttery Co-Investment

Illustrative Entity Chart

*Depicts Partner Investor’s investment in the first three Puttery locations in Dallas, TX, Charlotte, NC and Washington, D.C., without giving effect to the exercise of

an Upsize Option.