UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

| |

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2018

or

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission File Number: 001-31458

(Exact name of registrant as specified in its charter)

|

| | |

Maryland | | 81-0559116 |

(State or other jurisdiction of incorporation | | (I.R.S. Employer Identification No.) |

or organization) | | |

|

| | |

111 W. 19th Street, New York, NY | | 10011 |

(Address of principal executive offices) | | (Zip Code) |

(Registrant’s telephone number, including area code)

|

|

(Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes S No £

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

S Yes No £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer £ Accelerated filer S Non-accelerated filer £

Smaller reporting company £ Emerging growth company £

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. £

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes £ No S

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the last practicable date.

Common stock, $0.01 par value per share: 67,027,104 shares outstanding as of November 1, 2018.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This report contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements relate to, among other things, our operating performance, the performance of our investments, the stability of our earnings, and our financing needs. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “could,” “project,” “forecast,” “predict,” “continue” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, contain projections of results of operations or of financial condition or state other forward-looking information. Our ability to predict results or the actual outcome of future plans or strategies is inherently uncertain. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from forecasted results. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to:

| |

• | the ability to retain and attract members and guests to our properties; |

| |

• | changes in global, national and local economic conditions, including, but not limited to, changes in consumer spending patterns, a prolonged economic slowdown and a downturn in the real estate market; |

| |

• | effects of unusual weather patterns and extreme weather events, geographical concentrations with respect to our operations and seasonality of our business; |

| |

• | competition within the industries in which we operate or may pursue additional investments, including competition for sites for our Entertainment Golf venues; |

| |

• | material increases in our expenses, including but not limited to unanticipated labor issues, rent or costs with respect to our workforce, and costs of goods, utilities and supplies; |

| |

• | our inability to sell or exit certain properties, and unforeseen changes to our ability to develop, redevelop or renovate certain properties; |

| |

• | our ability to further invest in our business and implement our strategies; |

| |

• | difficulty monetizing our real estate debt investments; |

| |

• | liabilities with respect to inadequate insurance coverage, accidents or injuries on our properties, adverse litigation judgments or settlements, or membership deposits; |

| |

• | changes to and failure to comply with relevant regulations and legislation, including in order to maintain certain licenses and permits, and environmental regulations in connection with our operations; |

| |

• | inability to execute on our growth and development strategy by successfully developing, opening and operating new venues; |

| |

• | impacts of failures of our information technology and cybersecurity systems; |

| |

• | the impact of any current or further legal proceedings and regulatory investigations and inquiries; |

| |

• | the impact of any material transactions with FIG LLC (the former “Manager”) or one of its affiliates, including the termination of our management agreement and the transition services agreement and the impact of any actual, potential or predicted conflicts of interest; |

| |

• | the effect of the internalization of the Company's management (the “Internalization”) on our business and operations; and |

| |

• | other risks detailed from time to time below, particularly under the heading “Risk Factors,” and in our other reports filed with or furnished to the Securities and Exchange Commission (the “SEC”). |

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. The factors noted above could cause our actual results to differ significantly from those contained in any forward-looking statement.

Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our management’s views only as of the date of this report. We are under no duty to update any of the forward-looking statements after the date of this report to conform these statements to actual results.

SPECIAL NOTE REGARDING EXHIBITS

In reviewing the agreements included as exhibits to this Quarterly Report on Form 10-Q, please remember they are included to provide you with information regarding their terms and are not intended to provide any other factual or disclosure information about Drive Shack Inc. (the “Company”) or the other parties to the agreements. The agreements contain representations and warranties by each of the parties to the applicable agreement. These representations and warranties have been made solely for the benefit of the other parties to the applicable agreement and:

| |

• | should not in all instances be treated as categorical statements of fact, but rather as a way of allocating the risk to one of the parties if those statements prove to be inaccurate; |

| |

• | have been qualified by disclosures that were made to the other party in connection with the negotiation of the applicable agreement, which disclosures are not necessarily reflected in the agreement; |

| |

• | may apply standards of materiality in a way that is different from what may be viewed as material to you or other investors; and |

| |

• | were made only as of the date of the applicable agreement or such other date or dates as may be specified in the agreement and are subject to more recent developments. |

Accordingly, these representations and warranties may not describe the actual state of affairs as of the date they were made or at any other time. Additional information about the Company may be found elsewhere in this Quarterly Report on Form 10-Q and the Company’s other public filings, which are available without charge through the SEC’s website at http://www.sec.gov.

The Company acknowledges that, notwithstanding the inclusion of the foregoing cautionary statements, it is responsible for considering whether additional specific disclosures of material information regarding material contractual provisions are required to make the statements in this report not misleading.

DRIVE SHACK INC.

FORM 10-Q

INDEX

|

| | | |

| | PAGE |

PART I. FINANCIAL INFORMATION | | |

| | | |

Item 1. | Financial Statements | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

DRIVE SHACK INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(dollars in thousands, except share data)

|

| | | | | | | |

| (Unaudited) | | |

| September 30, 2018 | | December 31, 2017 |

Assets | | | |

Current assets | | | |

Cash and cash equivalents | $ | 99,389 |

| | $ | 167,692 |

|

Restricted cash | 4,176 |

| | 5,178 |

|

Accounts receivable, net | 9,209 |

| | 8,780 |

|

Real estate assets, held-for-sale, net | 158,602 |

| | 2,000 |

|

Real estate securities, available-for-sale | 3,202 |

| | 2,294 |

|

Other current assets | 26,257 |

| | 21,568 |

|

Total current assets | 300,835 |

| | 207,512 |

|

Restricted cash, noncurrent | 1,012 |

| | 818 |

|

Property and equipment, net of accumulated depreciation | 101,582 |

| | 241,258 |

|

Intangibles, net of accumulated amortization | 50,121 |

| | 57,276 |

|

Other investments | 22,265 |

| | 21,135 |

|

Other assets | 10,950 |

| | 8,649 |

|

Total assets | $ | 486,765 |

| | $ | 536,648 |

|

| | | |

Liabilities and Equity | | | |

Current liabilities | | | |

Credit facilities and obligations under capital leases | $ | 106,377 |

| | $ | 4,652 |

|

Membership deposit liabilities | 8,863 |

| | 8,733 |

|

Accounts payable and accrued expenses | 40,487 |

| | 36,797 |

|

Deferred revenue | 6,880 |

| | 31,207 |

|

Real estate liabilities, held-for-sale | 5,147 |

| | — |

|

Other current liabilities | 14,646 |

| | 22,596 |

|

Total current liabilities | 182,400 |

| | 103,985 |

|

Credit facilities and obligations under capital leases - noncurrent | 11,582 |

| | 112,105 |

|

Junior subordinated notes payable | 51,202 |

| | 51,208 |

|

Membership deposit liabilities, noncurrent | 89,549 |

| | 86,523 |

|

Deferred revenue, noncurrent | 7,817 |

| | 6,930 |

|

Other liabilities | 5,247 |

| | 4,846 |

|

Total liabilities | $ | 347,797 |

| | $ | 365,597 |

|

| | | |

Commitments and contingencies |

|

| |

|

|

| | | |

Equity | | | |

Preferred stock, $0.01 par value, 100,000,000 shares authorized, 1,347,321 shares of 9.75% Series B Cumulative Redeemable Preferred Stock, 496,000 shares of 8.05% Series C Cumulative Redeemable Preferred Stock, and 620,000 shares of 8.375% Series D Cumulative Redeemable Preferred Stock, liquidation preference $25.00 per share, issued and outstanding as of September 30, 2018 and December 31, 2017 | $ | 61,583 |

| | $ | 61,583 |

|

Common stock, $0.01 par value, 1,000,000,000 shares authorized, 67,027,104 and 66,977,104 shares issued and outstanding at September 30, 2018 and December 31, 2017, respectively | 670 |

| | 670 |

|

Additional paid-in capital | 3,174,948 |

| | 3,173,281 |

|

Accumulated deficit | (3,100,404 | ) | | (3,065,853 | ) |

Accumulated other comprehensive income | 2,171 |

| | 1,370 |

|

Total equity | $ | 138,968 |

| | $ | 171,051 |

|

| | | |

Total liabilities and equity | $ | 486,765 |

| | $ | 536,648 |

|

See notes to Consolidated Financial Statements.

DRIVE SHACK INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(dollars in thousands, except share data)

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2018 | | 2017 | | 2018 | | 2017 |

Revenues | |

| | |

| | |

| | |

|

Golf operations | $ | 68,928 |

| | $ | 62,034 |

| | $ | 191,632 |

| | $ | 168,969 |

|

Sales of food and beverages | 18,491 |

| | 19,657 |

| | 53,451 |

| | 53,223 |

|

Total revenues | 87,419 |

| | 81,691 |

| | 245,083 |

| | 222,192 |

|

| | | | | | | |

Operating costs | | | | | | | |

Operating expenses | 70,330 |

| | 63,384 |

| | 194,751 |

| | 175,920 |

|

Cost of sales - food and beverages | 5,180 |

| | 5,721 |

| | 15,413 |

| | 15,762 |

|

General and administrative expense | 10,149 |

| | 8,188 |

| | 29,611 |

| | 22,734 |

|

Management fee to affiliate | — |

| | 2,678 |

| | — |

| | 8,032 |

|

Depreciation and amortization | 4,495 |

| | 6,187 |

| | 14,358 |

| | 17,952 |

|

Pre-opening costs | 245 |

| | 141 |

| | 2,048 |

| | 191 |

|

Impairment | 4,172 |

| | 28 |

| | 5,645 |

| | 60 |

|

Realized and unrealized (gain) loss on investments | 48 |

| | (315 | ) | | (283 | ) | | 6,361 |

|

Total operating costs | 94,619 |

| | 86,012 |

| | 261,543 |

| | 247,012 |

|

Operating loss | (7,200 | ) | | (4,321 | ) | | (16,460 | ) | | (24,820 | ) |

| | | | | | | |

Other income (expenses) | | | | | | | |

Interest and investment income | 467 |

| | 8,418 |

| | 1,382 |

| | 22,701 |

|

Interest expense, net | (4,290 | ) | | (4,770 | ) | | (12,940 | ) | | (15,335 | ) |

Other (loss) income, net | (3,052 | ) | | 202 |

| | (7,157 | ) | | 372 |

|

Total other income (expenses) | (6,875 | ) | | 3,850 |

| | (18,715 | ) | | 7,738 |

|

Loss before income tax | (14,075 | ) | | (471 | ) | | (35,175 | ) | | (17,082 | ) |

Income tax (benefit) expense | — |

| | (2 | ) | | — |

| | 1,047 |

|

Net Loss | (14,075 | ) | | (469 | ) | | (35,175 | ) | | (18,129 | ) |

Preferred dividends | (1,395 | ) | | (1,395 | ) | | (4,185 | ) | | (4,185 | ) |

Loss Applicable to Common Stockholders | $ | (15,470 | ) | | $ | (1,864 | ) | | $ | (39,360 | ) | | $ | (22,314 | ) |

| | | | | | | |

Loss Applicable to Common Stock, per share | |

| | |

| | |

| | |

|

Basic | $ | (0.23 | ) | | $ | (0.03 | ) | | $ | (0.59 | ) | | $ | (0.33 | ) |

Diluted | $ | (0.23 | ) | | $ | (0.03 | ) | | $ | (0.59 | ) | | $ | (0.33 | ) |

| | | | | | | |

Weighted Average Number of Shares of Common Stock Outstanding | |

| | |

| | |

| | |

|

Basic | 66,992,322 |

| | 66,932,744 |

| | 66,982,233 |

| | 66,883,291 |

|

Diluted | 66,992,322 |

| | 66,932,744 |

| | 66,982,233 |

| | 66,883,291 |

|

See notes to Consolidated Financial Statements.

DRIVE SHACK INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (Unaudited)

(dollars in thousands, except share data)

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2018 | | 2017 | | 2018 | | 2017 |

Net loss | $ | (14,075 | ) | | $ | (469 | ) | | $ | (35,175 | ) | | $ | (18,129 | ) |

Other comprehensive income (loss): | |

| | |

| | |

| | |

|

Net unrealized gain on available-for-sale securities | 738 |

| | 1,257 |

| | 801 |

| | 2,524 |

|

Reclassification of net realized gain on securities into earnings | — |

| | (2,345 | ) | | — |

| | (2,345 | ) |

Other comprehensive income (loss) | 738 |

| | (1,088 | ) | | 801 |

| | 179 |

|

Total comprehensive loss | $ | (13,337 | ) | | $ | (1,557 | ) | | $ | (34,374 | ) | | $ | (17,950 | ) |

Comprehensive loss attributable to Drive Shack Inc. stockholders’ equity | $ | (13,337 | ) | | $ | (1,557 | ) | | $ | (34,374 | ) | | $ | (17,950 | ) |

See notes to Consolidated Financial Statements.

DRIVE SHACK INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF EQUITY (Unaudited)

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2018

(dollars in thousands, except share data)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Drive Shack Inc. Stockholders | |

| Preferred Stock | | Common Stock | |

| |

| |

| |

|

| Shares | | Amount | | Shares | | Amount | | Additional Paid-

in Capital | | Accumulated

Deficit | | Accumulated Other Comp.

Income | | Total Equity

(Deficit) |

Equity (deficit) - December 31, 2017 | 2,463,321 |

| | $ | 61,583 |

| | 66,977,104 |

| | $ | 670 |

| | $ | 3,173,281 |

| | $ | (3,065,853 | ) | | $ | 1,370 |

| | $ | 171,051 |

|

| | | | | | | | | | | | | | | |

Dividends declared | — |

| | — |

| | — |

| | — |

| | — |

| | (4,185 | ) | | — |

| | (4,185 | ) |

| | | | | | | | | | | | | | | |

Stock-based compensation | — |

| | — |

| | — |

| | — |

| | 1,357 |

| | — |

| | — |

| | 1,357 |

|

| | | | | | | | | | | | | | | |

Purchase of common stock (directors) | — |

| | — |

| | 50,000 |

| | — |

| | 310 |

| | — |

| | — |

| | 310 |

|

| | | | | | | | | | | | | | | |

Adoption of ASC 606 (Note 3) | — |

| | — |

| | — |

| | — |

| | — |

| | 4,809 |

| | — |

| | 4,809 |

|

| | | | | | | | | | | | | | | |

Comprehensive income (loss) |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | | | | | | | | | | | | | | |

Net loss | — |

| | — |

| | — |

| | — |

| | — |

| | (35,175 | ) | | — |

| | (35,175 | ) |

| | | | | | | | | | | | | | | |

Other comprehensive income | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 801 |

| | 801 |

|

| | | | | | | | | | | | | | | |

Total comprehensive loss | | | | | | | | | | | | | | | (34,374 | ) |

| | | | | | | | | | | | | | | |

Equity (deficit) - September 30, 2018 | 2,463,321 |

| | $ | 61,583 |

| | 67,027,104 |

| | $ | 670 |

| | $ | 3,174,948 |

| | $ | (3,100,404 | ) | | $ | 2,171 |

| | $ | 138,968 |

|

See notes to Consolidated Financial Statements.

DRIVE SHACK INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(dollars in thousands, except share data)

|

| | | | | | | |

| Nine Months Ended September 30, |

| 2018 | | 2017 |

Cash Flows From Operating Activities | | | |

Net loss | $ | (35,175 | ) | | $ | (18,129 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | |

| | |

|

Depreciation and amortization | 14,358 |

| | 17,952 |

|

Amortization of discount and premium | 891 |

| | (3,856 | ) |

Other amortization | 8,217 |

| | 7,889 |

|

Net interest income on investments accrued to principal balance | — |

| | (8,458 | ) |

Amortization of revenue on golf membership deposit liabilities | (1,127 | ) | | (963 | ) |

Amortization of prepaid golf membership dues | (19,570 | ) | | (20,017 | ) |

Stock-based compensation | 1,409 |

| | 376 |

|

Impairment | 5,645 |

| | 60 |

|

Equity in earnings from equity method investments, net of distributions | (1,123 | ) | | (1,149 | ) |

Other losses, net | 2,075 |

| | 5,368 |

|

Unrealized (gain) loss on investments | (283 | ) | | 1,246 |

|

Loss on extinguishment of debt | 66 |

| | 327 |

|

Change in: | |

| | |

|

Accounts receivable, net, other current assets and other assets - noncurrent | 1,436 |

| | (1,053 | ) |

Accounts payable and accrued expenses, deferred revenue, other current liabilities and other liabilities - noncurrent | 1,064 |

| | 5,405 |

|

Net cash used in operating activities | (22,117 | ) | | (15,002 | ) |

Cash Flows From Investing Activities | |

| | |

|

Principal repayments from investments | — |

| | 100,020 |

|

Proceeds from sale of property and equipment | 3,186 |

| | — |

|

Proceeds from sale of securities and loans | — |

| | 595,850 |

|

Net payments for settlement of TBAs | — |

| | (4,669 | ) |

Acquisition and additions of property and equipment and intangibles | (36,542 | ) | | (16,905 | ) |

Deposits paid on property and equipment | (8,246 | ) | | (1,486 | ) |

Contributions to equity method investees | (7 | ) | | (196 | ) |

Net cash (used in) provided by investing activities | (41,609 | ) | | 672,614 |

|

Cash Flows From Financing Activities | | | |

Borrowings under debt obligations | — |

| | 1,651 |

|

Repayments of debt obligations | (3,712 | ) | | (605,469 | ) |

Margin deposits under repurchase agreements and derivatives | — |

| | (89,692 | ) |

Return of margin deposits under repurchase agreements and derivatives | — |

| | 87,785 |

|

Golf membership deposits received | 2,544 |

| | 2,706 |

|

Issuance of common stock | 258 |

| | — |

|

Common stock dividends paid | — |

| | (8,019 | ) |

Preferred stock dividends paid | (4,185 | ) | | (4,185 | ) |

Payment of deferred financing costs | — |

| | (22 | ) |

Other financing activities | (290 | ) | | (504 | ) |

Net cash used in financing activities | (5,385 | ) | | (615,749 | ) |

Net Decrease in Cash and Cash Equivalents, Restricted Cash and Restricted Cash, noncurrent | (69,111 | ) | | 41,863 |

|

Cash and Cash Equivalents, Restricted Cash and Restricted Cash, noncurrent, Beginning of Period | 173,688 |

| | 146,544 |

|

Cash and Cash Equivalents, Restricted Cash and Restricted Cash, noncurrent, End of Period | $ | 104,577 |

| | $ | 188,407 |

|

| | | |

Supplemental Schedule of Non-Cash Investing and Financing Activities | | | |

Preferred stock dividends declared but not paid | $ | 930 |

| | $ | 930 |

|

Additions to capital lease assets and liabilities | $ | 4,035 |

| | $ | 3,601 |

|

Changes in property and equipment not yet paid for | $ | (945 | ) | | $ | 4,135 |

|

See notes to Consolidated Financial Statements.

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

SEPTEMBER 30, 2018

(dollars in tables in thousands, except share data)

1. ORGANIZATION

Drive Shack Inc., which is referred to, together with its subsidiaries, as “Drive Shack Inc.” or the “Company” is a leading owner and operator of golf-related leisure and entertainment businesses. The Company, a Maryland corporation, was formed in 2002, and its common stock is traded on the NYSE under the symbol “DS.”

The Company conducts its business through the following segments: (i) Traditional Golf properties, (ii) Entertainment Golf venues and (iii) corporate. For a further discussion of the reportable segments, see Note 4.

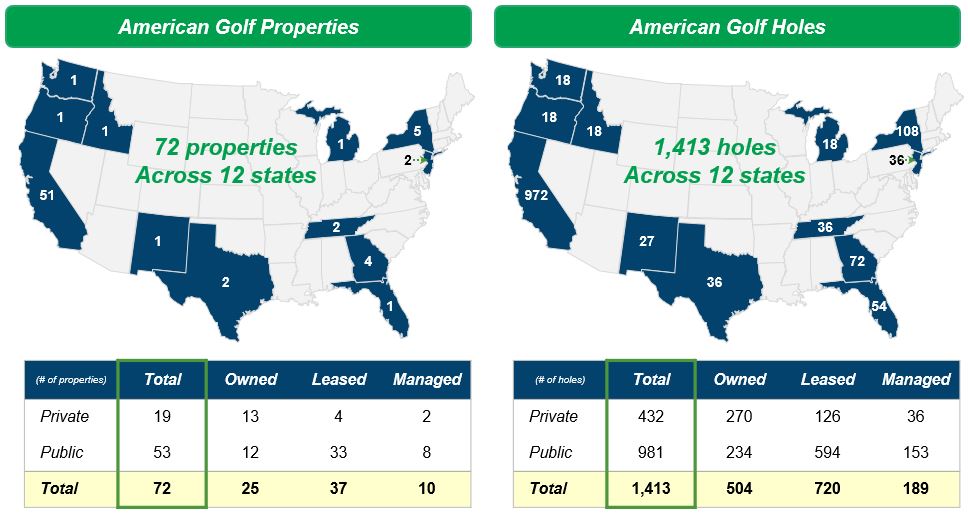

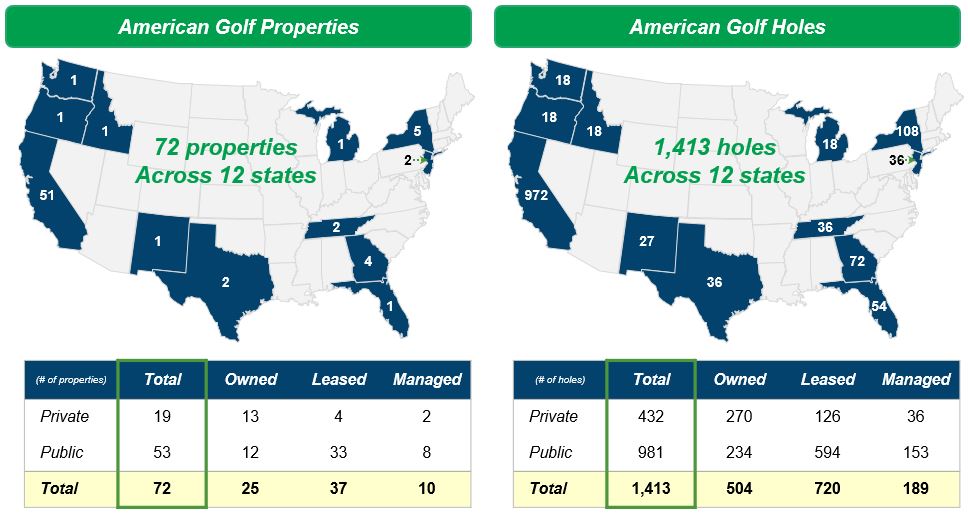

The Company’s Traditional Golf business is one of the largest owners and operators of golf properties in the United States. As of September 30, 2018, the Company owned, leased or managed 72 properties across 12 states.

The Company opened its first Entertainment Golf venue in Orlando, Florida on April 7, 2018. The Company expects to open a chain of next-generation Entertainment Golf venues across the United States and internationally which combine golf, competition, dining and fun.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation — The accompanying Consolidated Financial Statements and related notes of the Company have been prepared in accordance with accounting principles generally accepted in the United States for interim financial reporting and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, certain information and footnote disclosures normally included in financial statements prepared under U.S. generally accepted accounting principles (“GAAP”) have been condensed or omitted. In the opinion of management, all adjustments considered necessary for a fair presentation of the Company’s financial position, results of operations and cash flows have been included and are of a normal and recurring nature. The operating results presented for interim periods are not necessarily indicative of the results that may be expected for any other interim period or for the entire year. These financial statements should be read in conjunction with the Company’s Consolidated Financial Statements for the year ended December 31, 2017 and notes thereto included in the Company’s Annual Report on Form 10-K filed with the SEC on March 13, 2018. Capitalized terms used herein, and not otherwise defined, are defined in the Company’s Consolidated Financial Statements for the year ended December 31, 2017.

As of September 30, 2018, the Company’s significant accounting policies for these financial statements are summarized below and should be read in conjunction with the Summary of Significant Accounting Policies detailed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017.

Prior Period Reclassification — Certain prior period amounts have been reclassified to conform to the current period's presentation. Effective January 1, 2018, the Company internalized management (as discussed in Note 12) and records corporate overhead, including corporate payroll and related expenses, in "General and administrative expense" on the Consolidated Statements of Operations. Prior to January 1, 2018, the Company reported corporate overhead, including corporate payroll and related expenses, related to the Traditional Golf business in "Operating expenses" on the Consolidated Statements of Operations. The Company reclassified $3.9 million and $11.6 million, respectively, from "Operating expenses" to "General and administrative expense" for the three and nine months ended September 30, 2017.

The Company adopted ASU 2015-18 Statement of Cash Flows (Topic 230), Restricted Cash effective January 1, 2018, which requires retrospective adjustment to all periods. The addition of the reconciliation of restricted cash for the nine months ended September 30, 2017 included an increase of $1.9 million in "Margin deposits under repurchase agreements and derivatives."

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

SEPTEMBER 30, 2018

(dollars in tables in thousands, except share data)

REVENUE RECOGNITION

Golf Operations

Traditional Golf — Revenue from green fees, cart rentals, merchandise sales and other operating activities (consisting primarily of range income, banquets and club amenities) is generally recognized at the time of sale, when services are rendered and collection is reasonably assured.

Revenue from membership dues for private club members and The Players Club members is recognized in the month earned. Membership dues received in advance are included in deferred revenue and recognized as revenue ratably over the appropriate period, which is generally twelve months or less for private club members and the following month for The Players Club members. The membership dues are generally structured to cover the club operating costs and membership services.

Private country club members generally pay an advance initiation fee deposit upon their acceptance as a member to the respective country club. Initiation fee deposits are refundable 30 years after the date of acceptance as a member. The difference between the initiation fee deposit paid by the member and the present value of the refund obligation is deferred and recognized into revenue in the Consolidated Statements of Operations on a straight-line basis over the expected life of an active membership, which is estimated to be seven years. The determination of the estimated average expected life of an active membership is a significant judgment based on company-specific historical membership addition and attrition data. The present value of the refund obligation is recorded as a membership deposit liability in the Consolidated Balance Sheets and accretes over a 30-year nonrefundable term using the effective interest method. This accretion is recorded as interest expense in the Consolidated Statements of Operations.

Revenue from the reimbursement of certain operating costs incurred at the Company’s managed Traditional Golf properties is recognized at the time the associated operating costs are incurred as collection is reasonably assured per the terms of the management contracts and the repayment histories of the property owners.

Entertainment Golf — Revenue from bay play, events, and other operating activities (consisting primarily of instruction and merchandise sales) is generally recognized at the time of sale, when services are rendered and collection is reasonably assured.

Revenue from general memberships is recognized at the time of sale. Dues from other membership programs are included in deferred revenue and recognized as revenue ratably over the appropriate period, which is generally twelve months or less.

Sales of Food and Beverages — Revenue from food and beverage sales are recorded at the time of sale, net of discounts.

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

SEPTEMBER 30, 2018

(dollars in tables in thousands, except share data)

Realized and Unrealized (Gain) Loss on Investments and Other Income (Loss), Net — These items are comprised of the following: |

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2018 | | 2017 | | 2018 | | 2017 |

(Gain) on settlement of real estate securities | $ | — |

| | $ | (2,345 | ) | | $ | — |

| | $ | (2,345 | ) |

Loss on settlement of real estate securities | — |

| | — |

| | — |

| | 2,803 |

|

Unrealized loss on securities, intent-to-sell | — |

| | — |

| | — |

| | 558 |

|

(Gain) on settlement of loans held-for-sale | — |

| | — |

| | — |

| | (12 | ) |

Realized loss on settlement of TBAs, net | — |

| | 228 |

| | — |

| | 4,669 |

|

Unrealized loss (gain) on non-hedge derivative instruments | 48 |

| | 1,802 |

| | (283 | ) | | 688 |

|

Realized and unrealized (gain) loss on investments | $ | 48 |

| | $ | (315 | ) | | $ | (283 | ) | | $ | 6,361 |

|

| | | | | | | |

Loss on lease modifications and terminations | $ | (173 | ) | | $ | (1 | ) | | $ | (969 | ) | | $ | (161 | ) |

Gain (loss) on extinguishment of debt, net | 75 |

| | (145 | ) | | (66 | ) | | (327 | ) |

Collateral management fee income, net | 142 |

| | 92 |

| | 443 |

| | 341 |

|

Equity in earnings of equity method investments | 357 |

| | 387 |

| | 1,123 |

| | 1,149 |

|

(Loss) gain on disposal of long-lived assets and intangibles | (2,769 | ) | | (3 | ) | | (1,921 | ) | | 23 |

|

Other loss (A) | (684 | ) | | (128 | ) | | (5,767 | ) | | (653 | ) |

Other (loss) income, net | $ | (3,052 | ) | | $ | 202 |

| | $ | (7,157 | ) | | $ | 372 |

|

| |

(A) | During the nine months ended September 30, 2018, the Company recorded a net loss of approximately $4.9 million related to the settlement of a legal dispute and a related discharge of liabilities assumed by the counterparty to the settlement. See Note 13 for additional information. |

Reclassification From Accumulated Other Comprehensive Income Into Net Income — The following table summarizes the amounts reclassified out of accumulated other comprehensive income into net income:

|

| | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended September 30, | | Nine Months Ended September 30, |

Accumulated Other Comprehensive Income ("AOCI") Components | | Income Statement Location | | 2018 | | 2017 | | 2018 | | 2017 |

Net realized (gain) on securities: | | | | | | | | | | |

(Gain) on settlement of real estate securities | | Realized and unrealized (gain) loss on investments | | $ | — |

| | $ | (2,345 | ) | | $ | — |

| | $ | (2,345 | ) |

Total reclassifications | | | | $ | — |

| | $ | (2,345 | ) | | $ | — |

| | $ | (2,345 | ) |

EXPENSE RECOGNITION

Operating Expenses — Operating expenses consist primarily of payroll (Traditional Golf property level and Entertainment Golf venue level), utilities, repairs and maintenance, supplies, marketing and operating lease rent expense.

Traditional Golf

Operating expenses for Traditional Golf also include equipment and cart leases, seed, soil and fertilizer, and certain operating costs incurred at managed Traditional Golf properties. Many of the Traditional Golf properties and related facilities are leased under long-term operating leases. In addition to minimum payments, certain leases require payment of the excess of various percentages of gross revenue or net operating income over the minimum rental payments. The leases generally require the payment of taxes assessed against the leased property and the cost of insurance and maintenance. The majority of lease terms initially range from

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

SEPTEMBER 30, 2018

(dollars in tables in thousands, except share data)

10 to 20 years, and typically, the leases contain renewal options. Certain leases include scheduled increases or decreases in minimum rental payments at various times during the term of the lease. These scheduled rent increases or decreases are recognized on a straight-line basis over the term of the lease. Increases result in an accrual, which is included in other current liabilities and other liabilities, and decreases result in a receivable, which is included in other current assets and other assets, for the amount by which the cumulative straight-line rent differs from the contractual cash rent.

Entertainment Golf

Operating expenses for Entertainment Golf also include information technology-related support and maintenance.

General and Administrative Expense — General and administrative expense consists of costs associated with corporate and administrative functions that support development and operations.

Pre-Opening Costs — Pre-opening costs are expensed as incurred and consist primarily of marketing expenses, rent, employee payroll, travel and related expenses, training costs, food, beverage and other restaurant operating expenses incurred prior to opening an Entertainment Golf venue.

Derivatives and Hedging Activities — All derivatives are recognized as either assets or liabilities on the balance sheet and measured at fair value. The Company reports the fair value of derivative instruments gross of cash paid or received pursuant to credit support agreements and fair value is reflected on a net counterparty basis when the Company believes a legal right of offset exists under an enforceable netting agreement. Changes in fair value are recorded in net income. Derivative transactions are entered into by the Company solely for risk management purposes in the ordinary course of business. As of September 30, 2018, the Company had one interest rate cap with a fair value of $0.6 million which was not designated as a hedge.

BALANCE SHEET MEASUREMENT

Property and Equipment, Net — Real estate and related improvements are recorded at cost less accumulated depreciation. Costs that both materially add value to an asset and extend the useful life of an asset by more than a year are capitalized. The Company capitalizes to construction in progress certain costs related to properties under construction. Capitalization begins when the activities related to development have begun and ceases when activities are substantially complete and the asset is available for use. Capitalized costs include development, construction-related costs and interest expense.

Depreciation is calculated using the straight-line method based on the following estimated useful lives:

|

| |

Buildings and improvements | 10-30 years |

Capital leases - equipment | 3-7 years |

Furniture, fixtures and equipment | 2-7 years |

Long-lived assets to be disposed of by sale, which meet certain criteria, are reclassified to real estate held-for-sale and measured at the lower of their carrying amount or fair value less costs of sale. The Company suspends depreciation and amortization for assets held-for-sale. Subsequent changes to the estimated fair value less costs to sell will impact the measurement of assets held-for-sale. Decreases are recognized as an impairment loss and recorded in "Impairment" on the Consolidated Statements of Operations. To the extent the fair value increases, any previously reported impairment is reversed. Real estate held-for-sale is recorded in “Real estate assets, held-for-sale, net” and “Real estate liabilities, held-for-sale” on the Consolidated Balance Sheets.

Traditional Golf

With respect to Traditional Golf course improvements (included in buildings and improvements), costs associated with construction, significant replacements, permanent landscaping, sand traps, fairways, tee boxes or greens are capitalized. All other asset-related costs that do not meet these criteria, such as minor repairs and routine maintenance, are expensed as incurred.

The Company leases certain golf carts and other equipment that are classified as capital leases. The value of capital leases is recorded as an asset on the balance sheet, along with a liability related to the present value of associated payments. Depreciation of capital lease assets is calculated using the straight-line method over the shorter of the estimated useful lives or the expected lease terms. The cost of equipment under capital leases is recorded in "Property and equipment, net of accumulated depreciation"

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

SEPTEMBER 30, 2018

(dollars in tables in thousands, except share data)

on the Consolidated Balance Sheets. Payments under the leases are treated as reductions of the obligations under capital leases, with a portion being recorded as interest expense under the effective interest method.

Entertainment Golf

Entertainment Golf includes land, buildings, furniture, fixtures and equipment and leasehold improvements including building and land improvements.

Intangibles, Net — Intangible assets and liabilities consist primarily of leasehold advantages (disadvantages), management contracts, membership base and internally-developed software. A leasehold advantage (disadvantage) exists to the Company when it pays a contracted rent that is below (above) market rents at the date of an acquisition transaction. The value of a leasehold advantage (disadvantage) is calculated based on the differential between market and contracted rent, which is tax effected and discounted to present value based on an after-tax discount rate corresponding to each property and is amortized over the term of the underlying lease agreement. The management contract intangible represents the Company’s golf course management contracts for both leased and managed properties. The management contract intangible for leased and managed properties is valued using the discounted cash flow method under the income approach and is amortized over the term of the underlying lease or management agreements, respectively. The membership base intangible represents the Company’s relationship with its private country club members. The membership base intangible is valued using the multi-period excess earnings method under the income approach, and is amortized over the expected life of an active membership. The internally-developed software intangible represents proprietary software developed for the Company’s exclusive use. For Traditional Golf, the internally-developed software intangible is valued using the discounted cash flow method under the income approach at the date of an acquisition transaction. For Entertainment Golf, the internally-developed software intangible is composed of costs incurred to develop the software. The internally-developed software intangible is amortized over the expected useful life of the software.

Amortization of leasehold intangible assets and liabilities is included within operating expenses and amortization of all other intangible assets is included within depreciation and amortization in the Consolidated Statements of Operations. Amortization of all intangible assets is calculated using the straight-line method based on the following estimated useful lives:

|

| |

Trade name | 30 years |

Leasehold intangibles | 2-26 years |

Management contracts | 2-26 years |

Internally-developed software | 5-10 years |

Membership base | 7 years |

Liquor licenses | Nonamortizable |

Membership Deposit Liabilities — Private country club members in our Traditional Golf business generally pay an advance initiation fee deposit upon their acceptance as a member to the respective country club. Initiation fee deposits are refundable 30 years after the date of acceptance as a member. The difference between the initiation fee deposit paid by the member and the present value of the refund obligation is deferred and recognized into Golf operations revenue in the Consolidated Statements of Operations on a straight-line basis over the expected life of an active membership, which is estimated to be seven years. The present value of the refund obligation is recorded as a membership deposit liability in the Consolidated Balance Sheets and accretes over a 30-year nonrefundable term using the effective interest method. This accretion is recorded as interest expense in the Consolidated Statements of Operations.

Other Investment — The Company owns an approximately 22% economic interest in a limited liability company which owns preferred equity secured by a commercial real estate project. The Company accounts for this investment as an equity method investment. As of September 30, 2018 and December 31, 2017, the carrying value of this investment was $22.3 million and $21.1 million, respectively. The Company evaluates its equity method investment for other-than-temporary impairment whenever events or changes in circumstances indicate that the carrying amount of the investment might not be recoverable. The evaluation of recoverability is based on management’s assessment of the financial condition and near-term prospects of the commercial real estate project, the length of time and the extent to which the market value of the investment has been less than cost, availability and cost of financing, demand for space, competition for tenants, changes in market rental rates, and operating costs. As these factors are difficult to predict and are subject to future events that may alter management’s assumptions, the values estimated by management in its recoverability analyses may not be realized, and actual losses or impairment may be realized in the future.

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

SEPTEMBER 30, 2018

(dollars in tables in thousands, except share data)

Impairment of Real Estate and Finite-lived Intangible Assets — The Company periodically reviews the carrying amounts of its long-lived assets, including real estate held-for-use and held-for-sale, as well as finite-lived intangible assets, to determine whether current events or circumstances indicate that such carrying amounts may not be recoverable. The assessment of recoverability is based on management’s estimates by comparing the sum of the estimated undiscounted cash flows generated by the underlying asset, or other appropriate grouping of assets, to its carrying value to determine whether an impairment existed at its lowest level of identifiable cash flows. If the carrying amount of the asset is greater than the expected undiscounted cash flows to be generated by such asset, an impairment is recognized to the extent the carrying value of such asset exceeds its fair value. The Company generally measures fair value by considering sale prices for similar assets or by discounting estimated future cash flows using an appropriate discount rate. Assets to be disposed of are recorded at the lower of carrying amount or fair value less costs to sell.

Other Current Assets

The following table summarizes the Company's other current assets:

|

| | | | | | | | |

| | September 30, 2018 | | December 31, 2017 |

Loans, held-for-sale, net (A) | | $ | — |

| | $ | 147 |

|

Prepaid expenses | | 3,777 |

| | 3,081 |

|

Deposits | | 8,402 |

| | 3,469 |

|

Inventory | | 4,446 |

| | 4,722 |

|

Derivative assets | | 569 |

| | — |

|

Miscellaneous current assets, net | | 9,063 |

| | 10,149 |

|

Other current assets | | $ | 26,257 |

| | $ | 21,568 |

|

| |

(A) | During the nine months ended September 30, 2018, the Company recorded an impairment of $0.2 million on a corporate loan. |

Other Current Liabilities

The following table summarizes the Company's other current liabilities:

|

| | | | | | | | |

| | September 30, 2018 | | December 31, 2017 |

Security deposits payable | | $ | 6,186 |

| | $ | 6,602 |

|

Accrued rent | | 3,532 |

| | 2,160 |

|

Due to affiliates | | — |

| | 1,786 |

|

Dividends payable | | 930 |

| | 930 |

|

Miscellaneous current liabilities | | 3,998 |

| | 11,118 |

|

Other current liabilities | | $ | 14,646 |

| | $ | 22,596 |

|

Recent Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2014-09 Revenue from Contracts with Customers (Topic 606). The standard’s core principle is that a company will recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. The Company adopted the new guidance effective January 1, 2018 using the modified retrospective method. See Note 3 for additional information.

In January 2016, the FASB issued ASU 2016-01 Financial Instruments - Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities. The standard addresses certain aspects of recognition, measurement, presentation and disclosure of financial instruments. The Company adopted the new guidance effective January 1, 2018 and it did not have a material impact on the Consolidated Financial Statements.

In February 2016, the FASB issued ASU 2016-02 Leases (Topic 842). The standard requires lessees to recognize most leases on the balance sheet and addresses certain aspects of lessor accounting. The effective date of the standard will be for fiscal years, and

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

SEPTEMBER 30, 2018

(dollars in tables in thousands, except share data)

interim periods within those fiscal years, beginning after December 15, 2018 and early adoption is permitted. Entities are required to use a modified retrospective approach for leases that exist or are entered into after the beginning of the earliest comparative period in the financial statements, with an option to use certain relief. The Company currently has operating leases, including ground leases, for certain of its properties and leased equipment which are not recognized on the Consolidated Balance Sheets. In July 2018, the FASB issued ASU 2018-10 Codification Improvements to Topic 842 Leases, which provides 16 narrow scope amendments to ASC 842 including the rate implicit in the lease, impairment of the net investment in the lease, lessee reassessment of lease classification among other things. In July 2018 the FASB issued ASU 2018-11 Leases (Topic 842): Targeted Improvements which allows entities to not apply the new lease standard in the comparative periods presented in the financial statements in the year of adoption. The Company anticipates a significant increase to its non-current assets and non-current liabilities in order to record a right-of-use asset and a related lease liability, specifically as it relates to existing operating leases. There are also certain considerations related to internal control over financial reporting that are associated with implementing the new guidance under Topic 842. The Company is currently evaluating its control framework for lease accounting and identifying any changes that may need to be made in response to the new guidance. The Company has selected an information system application to centralize the tracking of and accounting for the Company’s leases and is currently in the process of implementing that application. The Company will adopt the requirements of the new standard on January 1, 2019. The Company is working to quantify the impact, but is currently unable to estimate the impact on the Consolidated Financial Statements.

In June 2016, the FASB issued ASU 2016-13 Financial Instruments - Credit Losses (Topic 326), Measurement of Credit Losses on Financial Instruments. The standard changes how entities will measure credit losses for most financial assets and certain other instruments that are not measured at fair value through net income. For available-for-sale debt securities, entities will be required to record allowances rather than reduce the carrying amount under the other-than-temporary impairment model. The effective date of the standard will be for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019 and early adoption is permitted for annual periods beginning after December 15, 2018. Entities will apply the standard's provisions as a cumulative-effect adjustment to retained earnings as of the beginning of the first reporting period in which the guidance is effective. The Company is currently evaluating the new guidance to determine the impact it may have on its Consolidated Financial Statements.

In August 2016, the FASB issued ASU 2016-15 Statement of Cash Flows (Topic 230), Classification of Certain Cash Receipts and Cash Payments. The standard provides specific guidance over eight identified cash flow issues in order to reduce diversity in practice over the presentation and classification of certain types of cash receipts and cash payments. The Company adopted the new guidance effective January 1, 2018 and it did not have a material impact on the Consolidated Statements of Cash Flows.

In November 2016, the FASB issued ASU 2016-18 Statement of Cash Flows (Topic 230), Restricted Cash. The standard requires entities to show the changes in the total of cash, cash equivalents and restricted cash in the statement of cash flows and provide a reconciliation to the related line items in the balance sheet. The Company adopted the new guidance effective January 1, 2018 and has included changes in restricted cash in the Consolidated Statements of Cash Flows for all periods presented.

In January 2017, the FASB issued ASU 2017-01 Business Combinations (Topic 805), Clarifying the Definition of a Business. The standard clarifies the definition of a business with the objective of adding guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets of businesses. The Company adopted the new guidance effective January 1, 2018 and it did not have a material impact on the Consolidated Financial Statements.

In August 2018, the FASB issued ASU 2018-15 Intangibles-Goodwill and Other-Internal Use Software (Subtopic 350-40): Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contract. The standard requires a customer in a cloud computing arrangement (i.e., a hosting arrangement) that is a service contract to follow the internal-use software guidance in ASC 350-40 to determine which implementation costs to capitalize as assets or expense as incurred. That guidance requires certain costs incurred during the application development stage to be capitalized and other costs incurred during the preliminary project and post-implementation stages to be expensed as they are incurred. Capitalized implementation costs related to a hosting arrangement that is a service contract will be amortized over the term of the hosting arrangement, beginning when the module or component of the hosting arrangement is ready for its intended use. The effective date of the standard will be for annual periods beginning after December 15, 2019. Early adoption is permitted, including adoption in any interim period. Entities can either apply the guidance prospectively to all implementation costs incurred after the date of adoption or retrospectively. The Company is currently evaluating the new guidance to determine the impact it may have on its Consolidated Financial Statements.

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

SEPTEMBER 30, 2018

(dollars in tables in thousands, except share data)

3. REVENUES

On January 1, 2018, the Company adopted the new accounting standard ASC 606, Revenue from Contracts with Customers, and all the related amendments (“new revenue standard”) for all contracts using the modified retrospective method. The Company recognized the cumulative effect of initially applying the new revenue standard as a decrease to the 2018 opening balance of accumulated deficit of $4.8 million and a corresponding decrease to other current liabilities, and the same decreases are applied to the September 30, 2018 balances. The adjustment was due to the recognition of breakage on gift cards and gift certificates offered at the Company's Traditional Golf properties that were not expected to be redeemed based on historical redemption rates. The recognition of breakage on gift cards and gift certificates on an ongoing basis is expected to have an immaterial impact to the Company’s net income (loss). Also in accordance with the new revenue standard, certain operating costs incurred at the Company’s managed Traditional Golf properties and the reimbursements of those operating costs will now be recognized in Operating expenses and Golf operations, respectively. The reimbursements do not include a profit margin and therefore this change will have no net impact to the Company’s operating income (loss).

The majority of the Company’s revenue continues to be recognized at the time of sale to customers at the Company’s Traditional Golf properties and Entertainment Golf venues, including green fees, cart rentals, bay play, events and sales of food, beverages and merchandise.

Per the modified retrospective method, comparative information has not been restated to conform to these changes and continues to be reported under the accounting standards in effect for those periods. In accordance with the new revenue standard requirements, the disclosure of the impact of adoption on the Consolidated Statements of Operations was as follows:

Consolidated Statement of Operations

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2018 | | Nine Months Ended September 30, 2018 |

| | As reported | | Balances under prior accounting | | Effect of Change | | As reported | | Balances under prior accounting | | Effect of Change |

Revenues | | | | | | | | | | | | |

Golf operations | | $ | 68,928 |

| | $ | 61,499 |

| | $ | 7,429 |

| | $ | 191,632 |

| | $ | 173,417 |

| | $ | 18,215 |

|

Operating Costs | | | | | | | | | | | | |

Operating expenses | | $ | 70,330 |

| | $ | 62,901 |

| | $ | 7,429 |

| | $ | 194,751 |

| | $ | 176,536 |

| | $ | 18,215 |

|

The Company’s revenue is all generated within the Traditional and Entertainment Golf segments. The following table disaggregates revenue by category: public and private golf properties (owned and leased), managed golf properties and Entertainment golf venues.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2018 | | Nine Months Ended September 30, 2018 |

| | Public golf properties | | Private golf properties | | Managed golf properties | | Ent. golf venues | | Total | | Public golf properties | | Private golf properties | | Managed golf properties | | Ent. golf venues | | Total |

Golf operations | | 34,689 |

| | 25,362 |

| | 8,167 |

| | 710 |

| | 68,928 |

| | 91,668 |

| | 78,202 |

| | 20,197 |

| | 1,565 |

| | 191,632 |

|

Sales of food and beverages | | 10,757 |

| | 6,904 |

| | — |

| | 830 |

| | 18,491 |

| | 30,271 |

| | 21,398 |

| | — |

| | 1,782 |

| | 53,451 |

|

Total revenues | | $ | 45,446 |

| | $ | 32,266 |

| | $ | 8,167 |

| | $ | 1,540 |

| | $ | 87,419 |

| | $ | 121,939 |

| | $ | 99,600 |

| | $ | 20,197 |

| | $ | 3,347 |

| | $ | 245,083 |

|

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

SEPTEMBER 30, 2018

(dollars in tables in thousands, except share data)

4. SEGMENT REPORTING

The Company currently has three reportable segments: (i) Traditional Golf properties, (ii) Entertainment Golf venues and (iii) corporate. The chief operating decision maker (“CODM”) for each segment is our Chief Executive Officer, who reviews discrete financial information for each reportable segment to manage the Company, including resource allocation and performance assessment.

The Company's Traditional Golf business is one of the largest owners and operators of golf properties in the United States. As of September 30, 2018, the Company owned, leased or managed 72 Traditional Golf properties across 12 states.

Additionally, the Company opened its inaugural Entertainment Golf venue in Orlando, Florida on April 7, 2018 and expects to continue opening a chain of next-generation Entertainment Golf venues across the United States and internationally, which combine golf, competition, dining and fun.

The corporate segment consists primarily of investments in loans and securities, interest income on short-term investments, general and administrative expenses as a public company, interest expense on the junior subordinated notes payable (Note 7), management fees pursuant to the Management Agreement prior to the Internalization effective January 1, 2018 (Note 12) and income tax expense (Note 14).

Beginning as of the Company’s second fiscal quarter in 2018, the Company changed its reportable segments to reflect the manner in which our CODM manages our businesses, including resource allocation and performance assessment. As a result, the Debt Investments segment was combined with the corporate segment, to reflect the ongoing reduction in size of the Debt Investments segment.

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

SEPTEMBER 30, 2018

(dollars in tables in thousands, except share data)

Summary financial data on the Company’s segments is given below, together with a reconciliation to the same data for the Company as a whole: |

| | | | | | | | | | | | | | | | |

| | Traditional Golf | | Entertainment Golf | | Corporate | | Total |

Nine Months Ended September 30, 2018 | | | | | | | | |

Revenues | | | | | | | | |

Golf operations | | $ | 190,067 |

| | $ | 1,565 |

| | $ | — |

| | $ | 191,632 |

|

Sales of food and beverages | | 51,669 |

| | 1,782 |

| | — |

| | 53,451 |

|

Total revenues | | 241,736 |

| | 3,347 |

| | — |

| | 245,083 |

|

Operating costs | | | | | | | | |

Operating expenses (A) | | 191,152 |

| | 3,599 |

| | — |

| | 194,751 |

|

Cost of sales - food and beverages | | 14,981 |

| | 432 |

| | — |

| | 15,413 |

|

General and administrative expense | | 12,781 |

| | 4,515 |

| | 9,448 |

| | 26,744 |

|

General and administrative expense - acquisition and transaction expenses (B) | | 706 |

| | 2,024 |

| | 137 |

| | 2,867 |

|

Depreciation and amortization | | 13,198 |

| | 1,148 |

| | 12 |

| | 14,358 |

|

Pre-opening costs (C) | | — |

| | 2,048 |

| | — |

| | 2,048 |

|

Impairment | | 5,498 |

| | — |

| | 147 |

| | 5,645 |

|

Realized and unrealized (gain) on investments | | (283 | ) | | — |

| | — |

| | (283 | ) |

Total operating costs | | 238,033 |

| | 13,766 |

| | 9,744 |

| | 261,543 |

|

Operating income (loss) | | 3,703 |

| | (10,419 | ) | | (9,744 | ) | | (16,460 | ) |

Other income (expenses) | | | | | | | | |

Interest and investment income | | 144 |

| | 196 |

| | 1,042 |

| | 1,382 |

|

Interest expense (D) | | (12,149 | ) | | — |

| | (1,661 | ) | | (13,810 | ) |

Capitalized interest (D) | | 580 |

| | — |

| | 290 |

| | 870 |

|

Other (loss) income, net | | (8,715 | ) | | — |

| | 1,558 |

| | (7,157 | ) |

Total other income (expenses) | | (20,140 | ) | | 196 |

| | 1,229 |

| | (18,715 | ) |

Income tax expense | | — |

| | — |

| | — |

| | — |

|

Net loss | | (16,437 | ) | | (10,223 | ) | | (8,515 | ) | | (35,175 | ) |

Preferred dividends | | — |

| | — |

| | (4,185 | ) | | (4,185 | ) |

Loss applicable to common stockholders | | $ | (16,437 | ) | | $ | (10,223 | ) | | $ | (12,700 | ) | | $ | (39,360 | ) |

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

SEPTEMBER 30, 2018

(dollars in tables in thousands, except share data)

Summary segment financial data (continued).

|

| | | | | | | | | | | | | | | | |

| | Traditional Golf | | Entertainment Golf | | Corporate | | Total |

Three Months Ended September 30, 2018 | | | | | | | | |

Revenues | | | | | | | | |

Golf operations | | $ | 68,218 |

| | $ | 710 |

| | $ | — |

| | $ | 68,928 |

|

Sales of food and beverages | | 17,661 |

| | 830 |

| | — |

| | 18,491 |

|

Total revenues | | 85,879 |

| | 1,540 |

| | — |

| | 87,419 |

|

Operating costs | | | | | | | | |

Operating expenses (A) | | 68,565 |

| | 1,765 |

| | — |

| | 70,330 |

|

Cost of sales - food and beverages | | 4,976 |

| | 204 |

| | — |

| | 5,180 |

|

General and administrative expense | | 4,313 |

| | 1,878 |

| | 3,189 |

| | 9,380 |

|

General and administrative expense - acquisition and transaction expenses (B) | | 199 |

| | 570 |

| | — |

| | 769 |

|

Depreciation and amortization | | 3,877 |

| | 614 |

| | 4 |

| | 4,495 |

|

Pre-opening costs (C) | | — |

| | 245 |

| | — |

| | 245 |

|

Impairment | | 4,172 |

| | — |

| | — |

| | 4,172 |

|

Realized and unrealized loss on investments | | 48 |

| | — |

| | — |

| | 48 |

|

Total operating costs | | 86,150 |

| | 5,276 |

| | 3,193 |

| | 94,619 |

|

Operating loss | | (271 | ) | | (3,736 | ) | | (3,193 | ) | | (7,200 | ) |

Other income (expenses) | | | | | | | | |

Interest and investment income | | 48 |

| | 85 |

| | 334 |

| | 467 |

|

Interest expense (D) | | (4,050 | ) | | — |

| | (597 | ) | | (4,647 | ) |

Capitalized interest (D) | | 238 |

| | — |

| | 119 |

| | 357 |

|

Other (loss) income, net | | (3,548 | ) | | — |

| | 496 |

| | (3,052 | ) |

Total other income (expenses) | | (7,312 | ) | | 85 |

| | 352 |

| | (6,875 | ) |

Income tax expense | | — |

| | — |

| | — |

| | — |

|

Net loss | | (7,583 | ) | | (3,651 | ) | | (2,841 | ) | | (14,075 | ) |

Preferred dividends | | — |

| | — |

| | (1,395 | ) | | (1,395 | ) |

Loss applicable to common stockholders | | $ | (7,583 | ) | | $ | (3,651 | ) | | $ | (4,236 | ) | | $ | (15,470 | ) |

|

| | | | | | | | | | | | | | | | |

| | Traditional Golf | | Entertainment Golf | | Corporate (E) | | Total |

September 30, 2018 | | | | | | | | |

Total assets | | 300,404 |

| | 99,470 |

| | 86,891 |

| | 486,765 |

|

Total liabilities | | 279,775 |

| | 10,097 |

| | 57,925 |

| | 347,797 |

|

Preferred stock | | — |

| | — |

| | 61,583 |

| | 61,583 |

|

Equity attributable to common stockholders | | $ | 20,629 |

| | $ | 89,373 |

| | $ | (32,617 | ) | | $ | 77,385 |

|

| | | | | | | | |

Additions to property and equipment (including capital leases) during the nine months ended September 30, 2018 | | $ | 11,651 |

| | $ | 25,689 |

| | $ | — |

| | $ | 37,340 |

|

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

SEPTEMBER 30, 2018

(dollars in tables in thousands, except share data)

Summary segment financial data (continued).

|

| | | | | | | | | | | | | | | | |

| | Traditional Golf | | Entertainment Golf | | Corporate (F) | | Total |

Nine Months Ended September 30, 2017 | | | | | | | | |

Revenues | | | | | | | | |

Golf operations | | $ | 168,969 |

| | $ | — |

| | $ | — |

| | $ | 168,969 |

|

Sales of food and beverages | | 53,223 |

| | — |

| | — |

| | 53,223 |

|

Total revenues | | 222,192 |

| | — |

| | — |

| | 222,192 |

|

Operating costs | | | | | | | | |

Operating expenses (A) | | 175,920 |

| | — |

| | — |

| | 175,920 |

|

Cost of sales - food and beverages | | 15,762 |

| | — |

| | — |

| | 15,762 |

|

General and administrative expense | | 12,418 |

| | 53 |

| | 5,412 |

| | 17,883 |

|

General and administrative expense - acquisition and transaction expenses (B) | | 558 |

| | 4,122 |

| | 171 |

| | 4,851 |

|

Management fee to affiliate | | — |

| | — |

| | 8,032 |

| | 8,032 |

|

Depreciation and amortization | | 17,936 |

| | 16 |

| | — |

| | 17,952 |

|

Pre-opening costs (C) | | — |

| | 191 |

| | — |

| | 191 |

|

Impairment | | — |

| | — |

| | 60 |

| | 60 |

|

Realized and unrealized loss on investments | | 317 |

| | — |

| | 6,044 |

| | 6,361 |

|

Total operating costs | | 222,911 |

| | 4,382 |

| | 19,719 |

| | 247,012 |

|

Operating loss | | (719 | ) | | (4,382 | ) | | (19,719 | ) | | (24,820 | ) |

Other income (expenses) | | | | | | | | |

Interest and investment income | | 114 |

| | — |

| | 22,587 |

| | 22,701 |

|

Interest expense (D) | | (11,575 | ) | | — |

| | (3,835 | ) | | (15,410 | ) |

Capitalized interest (D) | | 75 |

| | — |

| | — |

| | 75 |

|

Other (loss) income, net | | (1,044 | ) | | — |

| | 1,416 |

| | 372 |

|

Total other income (expenses) | | (12,430 | ) | | — |

| | 20,168 |

| | 7,738 |

|

Income tax expense | | — |

| | — |

| | 1,047 |

| | 1,047 |

|

Net loss | | (13,149 | ) | | (4,382 | ) | | (598 | ) | | (18,129 | ) |

Preferred dividends | | — |

| | — |

| | (4,185 | ) | | (4,185 | ) |

Loss applicable to common stockholders | | $ | (13,149 | ) | | $ | (4,382 | ) | | $ | (4,783 | ) | | $ | (22,314 | ) |

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

SEPTEMBER 30, 2018

(dollars in tables in thousands, except share data)

Summary segment financial data (continued).

|

| | | | | | | | | | | | | | | | |

| | Traditional Golf | | Entertainment Golf | | Corporate (F) | | Total |

Three Months Ended September 30, 2017 | | | | | | | | |

Revenues | | | | | | | | |

Golf operations | | $ | 62,034 |

| | $ | — |

| | $ | — |

| | $ | 62,034 |

|

Sales of food and beverages | | 19,657 |

| | — |

| | — |

| | 19,657 |

|

Total revenues | | 81,691 |

| | — |

| | — |

| | 81,691 |

|

Operating costs | | | | | | | | |

Operating expenses (A) | | 63,384 |

| | — |

| | — |

| | 63,384 |

|

Cost of sales - food and beverages | | 5,721 |

| | — |

| | — |

| | 5,721 |

|

General and administrative expense | | 4,119 |

| | 10 |

| | 2,128 |

| | 6,257 |

|

General and administrative expense - acquisition and transaction expenses (B) | | 72 |

| | 1,804 |

| | 55 |

| | 1,931 |

|

Management fee to affiliate | | — |

| | — |

| | 2,678 |

| | 2,678 |

|

Depreciation and amortization | | 6,171 |

| | 16 |

| | — |

| | 6,187 |

|

Pre-opening costs (C) | | — |

| | 141 |

| | — |

| | 141 |

|

Impairment | | — |

| | — |

| | 28 |

| | 28 |

|

Realized and unrealized loss (gain) on investments | | 32 |

| | — |

| | (347 | ) | | (315 | ) |

Total operating costs | | 79,499 |

| | 1,971 |

| | 4,542 |

| | 86,012 |

|

Operating income (loss) | | 2,192 |

| | (1,971 | ) | | (4,542 | ) | | (4,321 | ) |

Other income (expenses) | | | | | | | | |

Interest and investment income | | 42 |

| | — |

| | 8,376 |

| | 8,418 |

|

Interest expense (D) | | (3,905 | ) | | — |

| | (940 | ) | | (4,845 | ) |

Capitalized interest (D) | | 75 |

| | — |

| | — |

| | 75 |

|

Other (loss) income, net | | (211 | ) | | — |

| | 413 |

| | 202 |

|

Total other income (expenses) | | (3,999 | ) | | — |

| | 7,849 |

| | 3,850 |

|

Income tax benefit | | — |

| | — |

| | (2 | ) | | (2 | ) |

Net loss (income) | | (1,807 | ) | | (1,971 | ) | | 3,309 |

| | (469 | ) |

Preferred dividends | | — |

| | — |

| | (1,395 | ) | | (1,395 | ) |

(Loss) Income applicable to common stockholders | | $ | (1,807 | ) | | $ | (1,971 | ) | | $ | 1,914 |

| | $ | (1,864 | ) |

| |

(A) | Operating expenses include rental expenses recorded under operating leases for carts and equipment in the amount of $0.5 million and $1.6 million for the three and nine months ended September 30, 2018, respectively, and $0.7 million and $2.3 million for the three and nine months ended September 30, 2017, respectively. Operating expenses also include amortization of favorable and unfavorable lease intangibles in the amount of $1.0 million and $3.1 million for the three and nine months ended September 30, 2018, respectively, and $1.0 million and $3.1 million for the three and nine months ended September 30, 2017, respectively. |

| |

(B) | Acquisition and transaction expenses include costs related to completed and potential acquisitions and transactions, which may include advisory, legal, accounting and other professional or consulting fees. |

| |

(C) | Pre-opening costs are expensed as incurred and consist primarily of site-related marketing expenses, pre-opening rent, employee payroll, travel and related expenses, training costs, food, beverage and other restaurant operating expenses incurred prior to opening an Entertainment Golf venue. |

| |

(D) | Interest expense includes the accretion of membership deposit liabilities in the amount of $1.7 million and $5.1 million for the three and nine months ended September 30, 2018, respectively, and $1.6 million and $4.8 million for the three and nine months ended September 30, 2017, respectively. Interest expense and capitalized interest total to interest expense, net on the Consolidated Statements of Operations. |

| |

(E) | Total assets in the corporate segment include an equity method investment in the amount of $22.3 million as of September 30, 2018 recorded in other investments on the Consolidated Balance Sheets. See Note 2 for additional information. |

| |

(F) | The Debt Investments segment and corporate segment as reported previously are combined to conform to the current period's presentation. |

DRIVE SHACK INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

SEPTEMBER 30, 2018

(dollars in tables in thousands, except share data)

5. PROPERTY AND EQUIPMENT, NET OF ACCUMULATED DEPRECIATION

The following table summarizes the Company’s property and equipment:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2018 | | December 31, 2017 |

| Gross Carrying Amount | | Accumulated Depreciation | | Net Carrying Value | | Gross Carrying Amount | | Accumulated Depreciation | | Net Carrying Value |

Land | $ | 5,105 |

| | $ | — |

| | $ | 5,105 |

| | $ | 88,251 |

| | $ | — |

| | $ | 88,251 |

|

Buildings and improvements | 71,697 |

| | (26,318 | ) | | 45,379 |

| | 154,769 |

| | (52,636 | ) | | 102,133 |

|

Furniture, fixtures and equipment | 26,944 |

| | (16,581 | ) | | 10,363 |

| | 33,109 |

| | (23,451 | ) | | 9,658 |

|

Capital leases - equipment | 28,624 |

| | (11,832 | ) | | 16,792 |

| | 24,949 |

| | (8,649 | ) | | 16,300 |

|

Construction in progress | 23,943 |

| | — |

| | 23,943 |

| | 24,916 |

| | — |

| | 24,916 |

|

Total Property and Equipment | $ | 156,313 |

| | $ | (54,731 | ) | | $ | 101,582 |

| | $ | 325,994 |

| | $ | (84,736 | ) | | $ | 241,258 |

|