Newcastle Investment Corp.

Investor Presentation

January 7, 2013

Issuer Free Writing Prospectus

Dated January 7, 2013

Filed Pursuant to Rule 433

Registration Statement No. 333-182103 |

Newcastle Investment Corp.

Investor Presentation

January 7, 2013

Issuer Free Writing Prospectus

Dated January 7, 2013

Filed Pursuant to Rule 433

Registration Statement No. 333-182103 |

Disclaimer and Notes

1

forward-looking statements relate to, among other things, the

operating performance of our investments, the completion of certain pending Excess MSR transactions, the proposed spin-off of

our residential business, the stability of our earnings, our financing

needs, potential investments, estimated investment returns and assumptions underlying those returns (including, but not

limited to, recapture rates, prepayments rates, default rates),

projected dividend growth, projected dividend yields and interest rate changes. Forward-looking statements are generally

identifiable by use of forward-looking terminology such as

"may," "will," "should," "potential," "intend," "expect," "endeavor," "seek," "anticipate," "estimate," "overestimate," "underestimate,"

"believe," "could," "project,"

"predict," "continue,“ “target” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations,

describe future plans and strategies, contain projections of results

of operations or of financial condition or state other forward-looking information. Our ability to predict results or the actual

outcome of future plans or strategies is inherently uncertain.

Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our

actual results and performance could differ materially from those set

forth in the forward-looking statements. These forward-looking statements involve risks, uncertainties and other factors

that may cause our actual results in future periods to differ

materially from forecasted results. Factors which could have a material adverse effect on our operations and future prospects

include, but are not limited to: reductions in cash flows received

from our investments; our ability to take advantage of opportunities in additional asset classes or types of assets, at attractive

risk-adjusted prices; our ability to leverage our RMBS portfolio,

our ability to collapse RMBS portfolios and CDOs, our ability to recover cash flows from our CDOs, our ability to take

advantage of opportunities in investments in excess mortgage

servicing rights; our ability to deploy capital accretively; the risks that prepayment, default and recovery rates on our real estate

securities and loan portfolios deteriorate compared to our

underwriting estimates; the relationship between yields on assets which are paid off and yields on assets in which such monies can be

reinvested; the relative spreads between the yield on the assets we

invest in and the cost of financing; changes in economic and market conditions generally and the real estate and bond

markets specifically; adverse changes in the financing markets we

access affecting our ability to finance our investments, or in a manner that maintains our historic net spreads; changing risk

assessments by lenders that potentially lead to increased margin

calls, not extending our repurchase agreements or other financings in accordance with their current terms or entering into new

financings with us; changes in interest rates and/or credit spreads,

as well as the success of any hedging strategy we may undertake in relation to such changes; the quality and size of the

investment pipeline and the rate at which we can invest our cash,

including cash inside our collateralized debt obligations, or CDOs; changes in the fair value of our excess servicing assets, our

dependence on mortgage servicers to service the mortgages underlying

our excess servicing assets, our ability to grow senior housing, GSE initiatives and other actions that may adversely

affect returns on our excess servicing assets; impairments in the

value of the collateral underlying our investments and the relation of any such impairments to our judgments as to whether

changes in the market value of our securities, loans or real estate

are temporary or not and whether circumstances bearing on the value of such assets warrant changes in carrying values;

legislative/regulatory changes, including, but not limited to, any

modification of the terms of loans; the availability and cost of capital for future investments; competition within the finance and

real estate industries; and other risks detailed from time to time in

our Securities and Exchange Commission reports. Readers are cautioned not to place undue reliance on any of these forward-

looking statements, which reflect our management's views as of the

date of this Presentation significantly from those contained in any forward-looking statement. Although we believe that the

expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, levels of activity, performance or achievements. We are under no duty to update

any of the forward-looking statements after the date of this

Presentation to conform these statements to actual results.

be earned over the expected average life of an investment (i.e.,

IRR), after giving effect to existing or anticipated leverage (if any), calculated on a weighted average basis, projected market

conditions and various other factors. Income recognized by the

Company in future periods may be significantly less than the income that would have been recognized if an expected or

targeted return were actually realized, and the estimates we use to

calculate expected or targeted returns would differ materially from actual results. Statements about expected or targeted

returns in this Presentation are forward-looking statements. You

should carefully read the cautionary statement above under the caption “Forward-Looking Statements,” which directly applies

to our discussion of expected or targeted returns. Actual

returns may differ materially from expected or targeted returns.

relied upon as the basis for making an investment decision.

Before you invest, you should

read the prospectus in that registration statement and other documents the Company has filed with the SEC for more complete information about the Company

and this offering. You may get these documents for free by visiting

EDGAR on the SEC Web site at: www.sec.gov. Alternatively, the Company, any underwriter or any dealer participating in

the offering will arrange to send you the prospectus if you request

it by calling Credit Suisse Securities (USA) LLC toll-free at (800) 221-1037, Barclays Capital Inc. toll-free at (888) 603-5847,

Citigroup toll-free at (800) 831-9146 or UBS Securities LLC

toll-free at (888) 827-7275.

This disclaimer applies to this document and the oral comments made by

the individuals presenting it (the “Presentation”).

Forward

–

Looking

Statements:

This

Presentation

contains

certain

"forward-looking

statements"

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Such

Expected

or

Targeted

Returns:

Expected

or

targeted

returns

are

estimates

of

the

Company

of

annualized

effective

rate

of

return

that

the

Company

presently

expects

or

targets

to

Past

performance:

In

all

cases

where

historical

performance

is

presented,

please

note

that

past

performance

is

not

a

reliable

indicator

of

future

results

and

should

not

be

Newcastle

Investment

Corp.

("Newcastle")

has

filed

a

registration

statement

(including

a

prospectus)

with

the

SEC

for

the

offering

to

which

this

communication

relates. |

Disclaimer and Notes –

Continued

2

30+ DQ – Percentage of loans that are delinquent by 30 days or

more Age (mths) or Loan Age (mths) or Seasoning (mths) – Weighted

average number of months loans are outstanding

Avg. Balance – Average loan balance remaining Cash Basis – Initial investment less cash received life to

date CLTV – Combined Loan-to-Value CPR – Constant Prepayment Rate Current LTV – Ratio of current loan balance to estimated current

asset value Cur UPB – UPB as of the end of the current month Excess MSRs – monthly interest payments generated by the MSRs,

net of a basic fee paid to the servicer

Orig. FICO – A borrower’s credit metric generated by the

credit scoring model created by the Fair Isaac Corporation at the time of purchase

LTD Cash Flows –Actual cash flow collected from the investment

as of the end of the current month

Orig. UPB – UPB as of the investment’s acquisition

date Proj. Future Cash Flows – Future cash flow projected with the

Company’s original underwriting assumptions

Recapture Rate – Percentage of fully prepaid loans that are

refinanced by Nationstar and will be put back into the pool

Uncollected Payments – Percentage of loans that missed their

most recent payment UPB – Unpaid Principal Balance Updated IRR – Internal rate of return calculated based on the

cash flow received to date through the current month and the projected future cash flow based on our original

underwriting assumptions. WA – Weighted Average WAL – Weighted Average Life WAC – Weighted Average Coupon

Abbreviations:

This Presentation may include abbreviations, which have the

following meanings: No reliance, no update and use of

information: You should not exclusively rely on the

Presentation as the basis upon which to make an investment decision. The Presentation does not

purport to be complete without consideration of the information in the

prospectus. The information in the Presentation is provided to you as of the dates indicated and Newcastle

does not intend to update the information after its distribution, even

in the event that the information becomes materially inaccurate. Certain information contained in the

Presentation includes calculations or figures that have been prepared

internally and have not been audited or verified by a third party. Use of different methods for preparing,

calculating or presenting information may lead to different results

and such differences may be material.

|

Executive Summary

We

believe

our

residential

business

line

has

reached

a

"critical

mass"

We expect separation of residential and commercial business lines

will unlock value for stockholders Transaction

1

–

We

committed

to

invest

approximately

$340

million

(1)

for

a

33%

interest

in

Excess

MSRs

on

four

loan

pools,

approximately

$215

billion

UPB

(2)

Transaction 2 –

On January 4, 2013, we invested $27 million for a 33% interest in

Excess MSRs on a $13 billion UPB pool of Ginnie Mae

loans We intend to publicly offer 40 million shares of common

stock 1)

We expect to invest $320 million based on expected UPB at expected

time of close. Targeted returns and cash flows assume this investment amount.

2)

UPB as of November 30, 2012.

3

3

2

1

Newcastle to spin off certain residential assets – establish New

Residential Investment Corp.

Announcement of two new Excess MSR investments – over $225 billion

UPB |

Spin-Off of Residential Assets

4

1 |

Overview of Spin-Off

Newcastle is currently housing a commercial business and a residential

business, each with significant growth potential

Spin-off will create a residential-focused mortgage REIT

(“New Residential”) Target assets include Excess

MSRs, RMBS, Non-Performing Loans, Servicing Advances

Fortress-managed –

substantially similar terms to Newcastle’s management

agreement NYSE listing expected

Potential dividend yield tightening relative to Newcastle’s

average 2012 dividend yield at 12% Spin-off approved by

Board of Directors Filed Form 10 with the SEC

Next Steps:

Complete SEC review and NYSE listing processes

Target distribution of New Residential shares in the first quarter

of 2013 5

1)

The spin-off may not have the full or any of the strategic and

financial benefits that we expect, or such benefits may be delayed or may not materialize at all.

2)

Distribution ratio is subject to change. The spin-off is

subject to certain conditions, such as the Securities and Exchange Commission (“SEC”) declaring the registration

statement relating to the spin-off effective, the filing and

approval of an application to list New Residential’s common stock on the NYSE, and the formal declaration of the

distribution by our Board of Directors. Expected

to

improve

transparency

and

unlock

shareholder

value

(1)

Plan

to

distribute

one

share

of

New

Residential

for

each

share

of

Newcastle

common

stock

(2) |

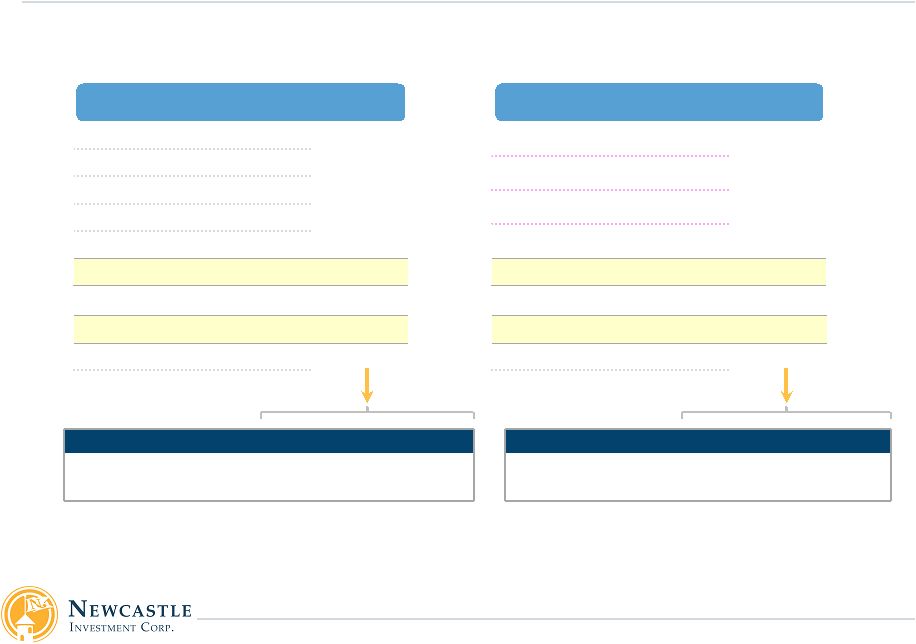

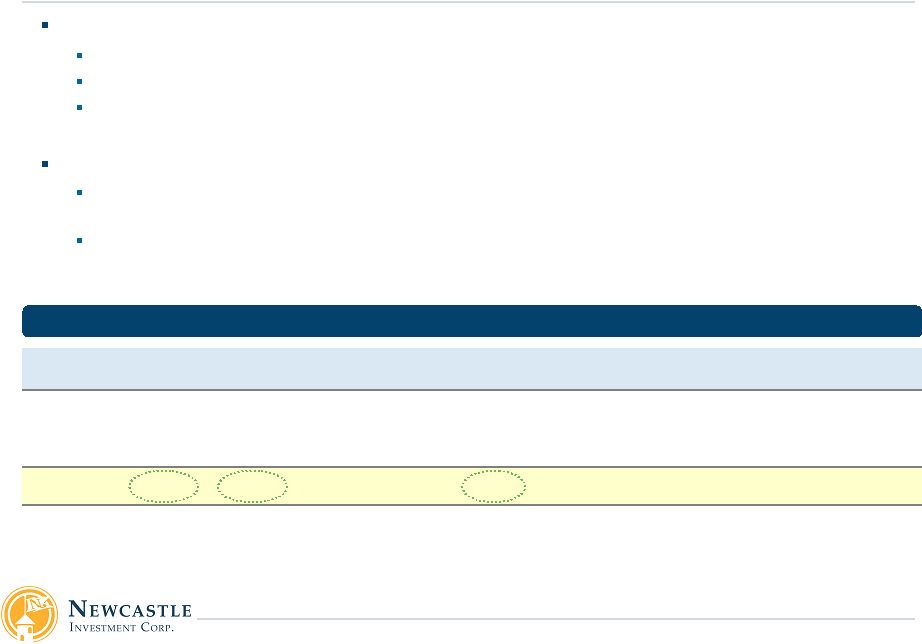

Separating the Two Businesses

We believe separating the two businesses will improve transparency and

unlock shareholder value With the new acquisitions, we anticipate

each business will be sizable enough to stand alone We

expect a significant investment pipeline for each business

1)

Investments other than the types highlighted may be made at the

Manager’s discretion as consistent with the company’s investment guidelines.

6

Post-Spin Newcastle

Target Assets

(1)

New Residential

Target Assets

(1)

Excess MSRs

RMBS

Non-Performing Loans

Servicing Advances

Newcastle

SPIN-OFF

Newcastle CDOs

Commercial RE Debt

Senior Housing |

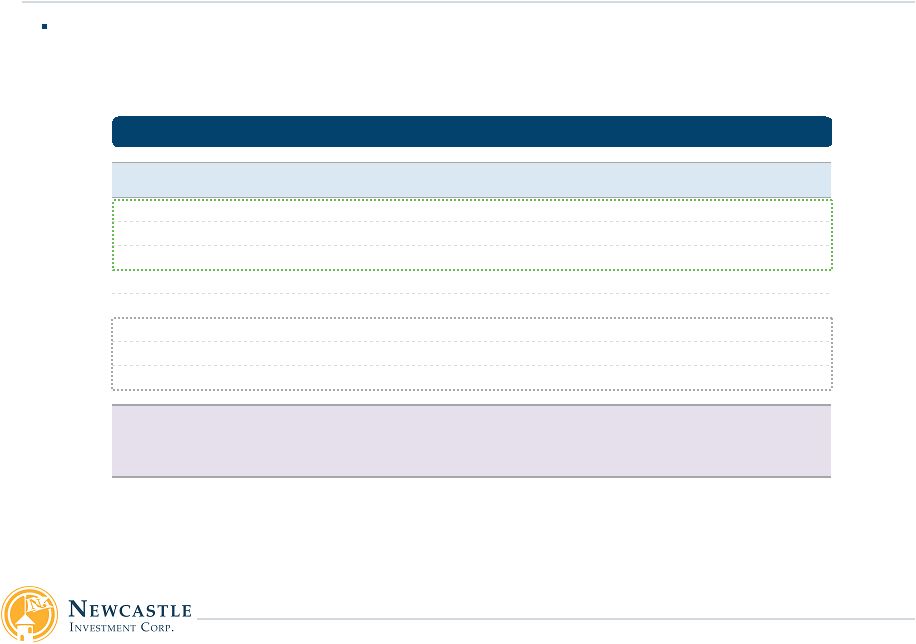

Targeted Economics of Our Two Businesses*

* Please refer to the following page for explanatory notes and

specific disclaimers related to the information presented on this page.

7

Excess MSRs

(2)

$258 mm

New

Excess

MSR

Transactions

(3)

$350 mm

Non-Agency RMBS

(4)

$200 mm

Less: Repo Debt

($60) mm

Investable Cash

(5)

$92 mm

Total

Residential

Value

(9)

$840 mm

Real

Estate

Debt

(6)

$725 mm

Senior Housing

(7)

$65 mm

Less:

Corporate

Debt

(8)

($112) mm

Investable Cash

(5)

$92 mm

Total

Commercial

Value

(9)

$770 mm

New Residential

(1)

Newcastle Post-Spin

Assumed

Dividend

Yield

(13)

7%

8%

9%

10%

Implied price / share:

$7.71

$6.75

$6.00

$5.40

Implied Market Cap.

$1.6bn

$1.4bn

$1.3bn

$1.1bn

Assumed Dividend Yield

(13)

7%

8%

9%

10%

Implied price / share:

$7.14

$6.25

$5.56

$5.00

Implied Market Cap.

$1.5bn

$1.3bn

$1.2bn

$1.1bn

Targeted

Net

IRR

(10)

14%

$115 mm

(11)

Per share

(12)

$0.54

Targeted

Net

IRR

(10)

14%

$106 mm

(11)

Per Share

(12)

$0.50 |

1)

Newcastle’s ability to complete a spin-off of New Residential

is subject to certain conditions, such as the SEC declaring the registration statement

relating to the spin-off effective, the filing and approval of an

application to list New Residential’s common stock on the NYSE, and the formal

declaration of the distribution by our Board of Directors. 2)

Reflects carrying value as of September 30, 2012 of $258

million.

3)

Reflects pro forma adjustments for $320 million expected investment

in Excess MSR Transaction 1 and $27 million investment in Excess MSR

Transaction 2.

4)

Reflects the carrying value as of September 30, 2012. 5) Investable cash for

each of New Residential and Newcastle post-spin reflect half of Newcastle’s total investable cash as of September 30, 2012 of

$184 million. The allocation of the September 30, 2012 cash balance

is for illustrative purposes only. Actual cash balance may differ materially.

6)

Reflects an unaudited estimate of expected future recovery value of

the principal as of September 30, 2012. This amount reflects a variety of

assumptions, and actual recovery value may differ materially from the

current estimate.

7)

Reflects net investment in senior housing as of September 30, 2012,

including working capital and related transaction costs.

8)

Reflects face amount of the junior subordinated notes and preferred

equity as of September 30, 2012.

9)

Does not reflect all of the assets New Residential and Newcastle will

own post-spin. Each of New Residential and Newcastle intend to own

other assets, including Agency RMBS, which could affect the total

value of each business.

10)

Targeted Net IRR may differ materially from actual returns. Targeted

Net IRRs indicated are based on a variety of assumptions and estimates,

including assumptions with respect to gross investment returns,

attainable leverage and estimates of corporate overhead expenses, which will

differ for each business. Net IRR will also be affected by the

matters identified in the prospectus supplement under “Risk Factors.” Following

the spin-off, corporate overhead expenses of Newcastle and New

Residential are expected to increase on an aggregate basis as a result of

management compensation and general and administrative expenses

payable by New Residential.

11)

Represents the product of Targeted Net IRR and Total Residential

Value or Total Commercial Value, as applicable. Slight inaccuracies are due to

rounding.

12)

Assumes completion of the proposed equity offering described herein

and the distribution of one share of New Residential for each share of

Newcastle, which may change prior to the distribution. Implied share

price does not reflect Newcastle’s expectation of the price at which it may

offer shares. Per share amount does not reflect potential dilution

from outstanding options for shares of Newcastle common stock and options

that Newcastle expects to issue for shares of New Residential.

Such dilution could be material.

13)

Dividend yields presented are for illustrative purposes only. Actual

dividends may differ materially. Corresponding price per share assumes

100% payout of stated per share amount. Targeted

Economics of Our Two Businesses – Explanatory Notes

8 |

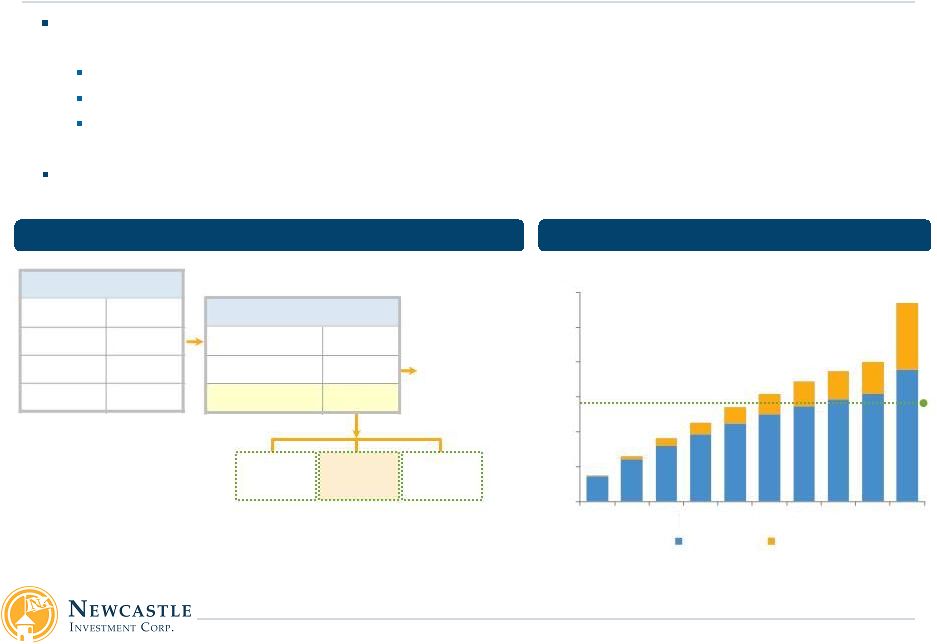

New Residential –

Potential Dividend Yield Tightening

1)

Source: SNL Financial. Stock Price as of 1/4/2013,

dividend yield based on last declared regular dividend.

2)

Portfolio composition from recent 3Q 2012 filings and presentations.

Peer group is a non-exhaustive list and inclusion of others may change minimum, maximum and average.

3)

Determination of comparability of subsets has been made by

management. Other industry participants may express a different view.

9

Dividend

Yield

Market

Cap ($mm)

Portfolio Composition

Redwood

5.6%

$1,467

Non-Agency MBS, Residential loans, Commercial loans (15%)

HLSS

7.4%

$1,081

MSRs (10%), Servicing Advances (90%)

PennyMac Mortgage Inv.

8.8%

$1,521

Distressed Mortgage Loans, MSRs

MFA Financial

9.3%

$3,061

Agency MBS (60%), Non-Agency MBS (40%)

Dynex Capital Inc.

11.8%

$535

Agency MBS (64%), CMBS (32%)

Invesco Mortgage Capital

12.3%

$2,456

Agency MBS (76%), Non-Agency MBS (14%), CMBS (10%)

AG Mortgage Inv. Trust

13.2%

$654

Agency MBS (80%), Non-Agency MBS (16%)

Two Harbors Inv. Corp.

18.8%

$3,462

Agency MBS (84%), Non-Agency MBS (16%)

Minimum

5.6%

$535

Average

10.9%

$1,780

Maximum

18.8%

$3,462

Less

comparable

subset

(3)

More

comparable

subset

(3)

Public

Residential

Mortgage

REITs

(1,2)

Residential peers with comparable portfolios trade at a 6 – 9%

yield, vs. Newcastle 2012 average at 12% |

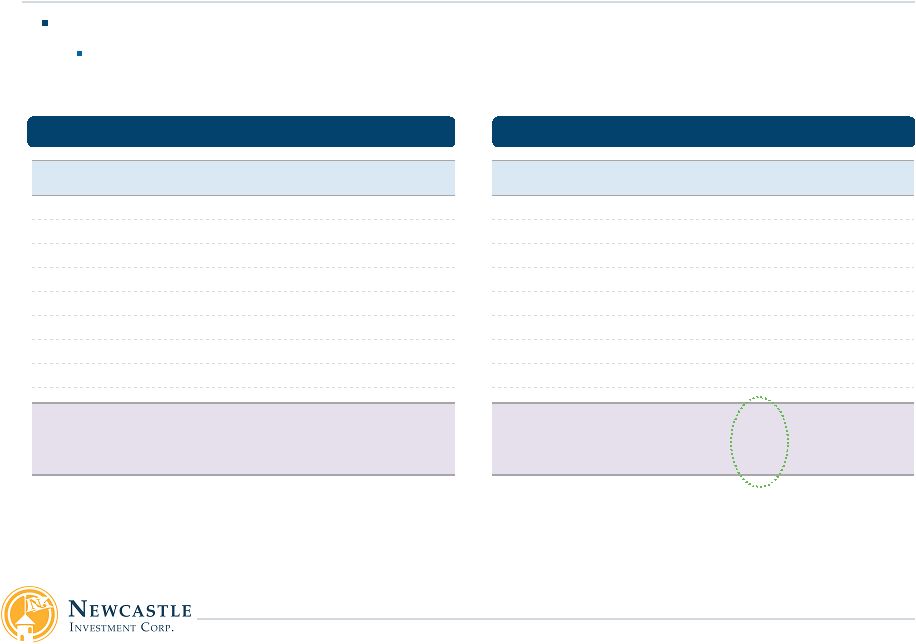

Newcastle

–

Potential Dividend Yield Tightening

Based on comparable peers, potential dividend yield tightening could

take place at Newcastle as well As senior housing portfolio

grows, further tightening expected toward range of public healthcare REITs

10

Dividend

Yield

Market Cap

($mm)

Arbor Realty Trust

6.7%

$205

RAIT Financial Trust

6.8%

$345

Colony Financial

7.0%

$1,056

Starwood Property Trust

7.4%

$3,224

NorthStar

9.2%

$1,206

Apollo Commercial RE

9.4%

$476

CreXus Investment Corp

10.3%

$955

Resource Capital

13.4%

$599

Minimum

6.7%

$205

Average

8.8%

$1,008

Maximum

13.4%

$3,224

Public

Healthcare

REITs

(1,2)

Dividend

Yield

Market Cap

($mm)

Ventas Inc.

3.8%

$19,205

HCP Inc.

4.4%

$20,735

National Health Investors

4.6%

$1,636

Health Care REIT Inc.

4.8%

$16,030

Healthcare Realty Trust

4.8%

$2,177

LTC Properties Inc.

5.1%

$1,108

Senior Housing Properties

6.4%

$4,303

Medical Properties Trust

6.5%

$1,678

Minimum

3.8%

$1,108

Average

5.0%

$8,359

Maximum

6.5%

$20,735

Public

Commercial

Finance

REITs

(1,2)

Additional yield tightening

expected as senior housing

portfolio grows

(3)

1) Source: SNL Financial. Stock Price as of 1/4/2013, dividend yield based on last declared regular dividend.

2) Peer group is a non-exhaustive list and inclusion of others

may change minimum, maximum and average.

3) The ability to grow the senior housing portfolio is subject to a number of factors and may not occur. Please see “Forward

Looking Statements.” |

Anticipated Separation Timing

We

intend

to

distribute

shares

of

New

Residential

in

the

first

quarter

of

2013

(1)

11

Announcement of board

approval of spin-off

Filed Form 10 with the SEC

Jan ‘13

Jan ‘13

Intend to distribute

shares of New

Residential

Feb ‘13

Feb ‘13

Mar ‘13

Mar ‘13

Expect to complete

SEC review &

NYSE listing

processes

1) There can be no assurance that the spin-off of New Residential

will be completed as anticipated or at all. The spin-off is subject to certain conditions, such as the SEC

declaring the registration statement relating to the

spin-off effective, the filing and approval of an application to list New Residential’s common stock on the NYSE, and the

formal declaration of the distribution by our Board of Directors.

|

12

Two New Excess MSR Transactions

2 |

Investment Highlights

Transaction

1

–

Approximately

$215

billion

UPB

(1)

We

committed

to

invest

approximately

$340

million

(2)

to

acquire

a

33%

interest

in

Excess

MSRs

In

our

base

case,

we

target

a

16%

unleveraged

IRR,

2.0x

investment

multiple

and

a

break-even

CPR

of

54%

(3)

Four loan pools: 47% Agency/Government loans and 53% PLS

loans Transaction

2

–

$13

billion

UPB

On January 4, 2013, we invested $27 million to acquire a 33%

interest in Excess MSRs on a pool of Ginnie Mae loans

In

our

base

case,

we

target

a

16%

unleveraged

IRR,

2.1x

investment

multiple

and

a

break-even

CPR

of

55%

(3)

1)

UPB as of November 30, 2012.

2)

Expect to invest $320 million based on expected UPB at time of

close. Targeted returns and cash flows assume this investment amount.

3)

Based upon various assumptions of management, including prepayment,

recapture and default rates. Actual results may differ materially.

4)

Represents Newcastle’s 33% interest in the Excess MSR.

13

UPB

NCT

Total

MSR

Basic

Fee

Excess

MSR

Avg.

Balance

WAC

Seasoning

Current

LTV

Orig.

FICO

30+

DQ

Transaction 1

$215bn

(1)

$340 mm

(2)

33 bps

19 bps

14 bps

$159k

5.32%

5.9 yrs

101%

704

27%

Transaction 2

$13 bn

$27 mm

40 bps

15 bps

25 bps

$149k

5.64%

3.6 yrs

101%

674

16%

TOTAL / WA

$228 bn

$367 mm

33 bps

19 bps

14 bps

$158k

5.34%

5.8 yrs

101%

702

26%

Collateral Characteristics

Commitment

(4) |

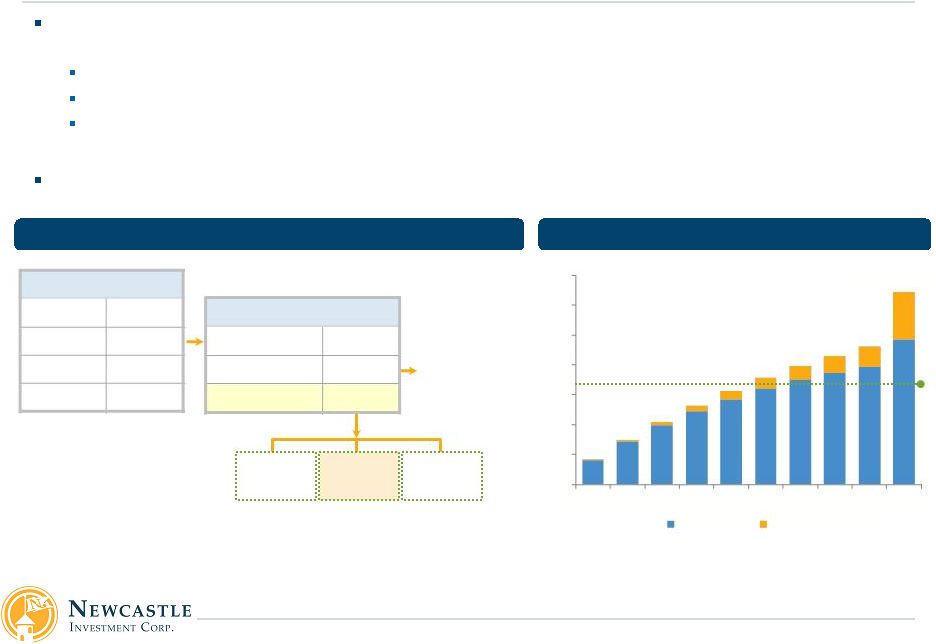

Transaction 1 –

Overview

(1)

Newcastle

committed

to

invest

approximately

$340

million

(2)

for

a

33%

interest

in

the

Excess

MSRs

on

four

Agency/Government

and

Private

Label

pools

that

total

approximately

$215

billion

UPB

(3,4)

Nationstar

will

service

the

loans

–

paid

a

19

bps

basic

fee

and

will

receive

all

originations

and

ancillary

income

Nationstar and a Fortress Fund will each own a 33% interest in the

Excess MSRs on the same terms as Newcastle Newcastle will not

have servicing duties or advance obligations associated with the pools

Newcastle

targets

receipt

of

$635

million

of

total

cash

flows

vs.

$320

million

expected

investment

(2)

1)

Based upon various assumptions of management, including prepayment,

recapture and default rates. Actual results may differ materially.

2)

Expect to invest $320 million based on expected UPB at time of close.

Targeted returns and cash flows assume this investment amount.

3)

UPB as of November 30, 2012.

4)

Investment is subject to closing conditions and third party

approvals. 14

Structure

Targeted NCT Cumulative Cash Flows

Paid to Nationstar

(Loan Servicer)

(mm)

Expected

Investment

of

$320

mm

(2)

Targeted Break-even of 5.3 yrs

33%

Fortress

Fund

33%

Newcastle

33%

Nationstar

MSR Breakdown

Total MSR

33 bps

Basic

Fee

(19 bps)

Excess MSR

14bps

Transaction

1

UPB

$215 bn

(3)

Total MSR

33 bps

WAC

5.3%

Seasoning

5.9yrs

$635 mm

$0

$100

$200

$300

$400

$500

$600

$700

Yr 1

Yr 2

Yr 3

Yr 4

Yr 5

Yr 6

Yr 7

Yr 8

Yr 9

Yr 10+

Original Pool

Recaptured Pool |

CPR

5%

10%

15%

20%

25%

IRR

21.3%

17.7%

15.5%

12.6%

10.1%

Cash Flows

$868.0

$721.8

$635.2

$568.1

$510.3

Investment Multiple

2.72x

2.26x

1.99x

1.78x

1.60x

CPR

5%

10%

15%

20%

25%

IRR

19.5%

14.4%

10.4%

5.1%

3.7%

Cash Flows

$786.7

$592.4

$488.2

$389.3

$319.0

Transaction 1 –

Newcastle Targeted Returns

15

CPR

5%

10%

15%

20%

25%

IRR

22.2%

19.4%

17.7%

15.6%

13.8%

Cash Flows

$912.0

$789.4

$729.5

$662.8

$613.0

0% Recapture

28% Recapture (Base Case)

45% Recapture

(Cash Flows: $mm)

Recapture

mitigates

prepayment

risk

1)

Actual results may differ materially from base case returns. Base

case numbers reflect a weighted average of four discrete pools each with their own set of default, delinquency,

prepayment and recapture assumptions. Weighted average Recapture Rate

of 28%, which depending on the pool ranges from 20% to 35%. Weighted average CPR of 15% (CPR ramp

assumes 21% for Year 1, 19% for Year 2). Weighted average lifetime

uncollected payment for Agency/Government loans of 8% (Uncollected payment 10% for Year 1 , 9% for Year 2).

Recaptured loans assume 10 CPR (8 CRR; 2 CDR); 28% Recapture, which

depending on the pool ranges from 20% to 35%.

We

target

a

base

case

return

of

15.5%

unleveraged

IRR,

$635

million

of

cashflows

and

a

2.0x

investment

multiple

–

assumes

15%

CPR

and

28%

recapture

rate

(1)

Loans

from

the

pools

refinanced

by

Nationstar

will

remain

within

the

pools

post

refinance

As recapture percentage increases, yield profile becomes less

sensitive to changes in prepayments In our base case, we

target a break-even CPR of 54% |

Nationstar

services

the

loans

–

paid

a

15

bps

basic

fee

and

receives

all

originations

and

ancillary

income

Nationstar and a Fortress Fund each own a 33% interest in the Excess

MSRs on the same terms as Newcastle Newcastle does not have

servicing duties or advance obligations associated with the pools

Transaction 2 –

Overview

(1)

1)

Based upon various assumptions of management, including prepayment,

recapture and default rates. Actual results may differ materially.

16

Structure

Targeted NCT Cumulative Cash Flows

Paid to Nationstar

(Loan Servicer)

(mm)

Initial Investment of $27 mm

Targeted Break-even of 5.1 yrs

MSR Breakdown

Total MSR

40 bps

Basic

Fee

(15 bps)

Excess MSR

25 bps

Transaction

2

UPB

$13 bn

Total MSR

40 bps

WAC

5.6%

Seasoning

3.6 yrs

33%

Nationstar

33%

Fortress

Fund

33%

Newcastle

$57 mm

$0

$10

$20

$30

$40

$50

$60

Yr 1

Yr 2

Yr 3

Yr 4

Yr 5

Yr 6

Yr 7

Yr 8

Yr 9

Yr 10+

Original Pool

Recaptured Pool

Newcastle targets receipt of $57 million of total cash flows vs. $27

million initial investment

On January 4, 2013, Newcastle invested $27 million for a 33%

interest in the Excess MSRs on a $13 billion UPB Ginnie Mae pool

of loans |

CPR

10%

15%

20%

25%

30%

IRR

17.5%

12.4%

7.9%

3.4%

-1.2%

Cash Flows

$65.3

$47.7

$37.8

$31.0

$26.2

CPR

10%

15%

20%

25%

30%

IRR

21.1%

18.1%

15.8%

13.7%

12.0%

Cash Flows

$78.0

$64.9

$57.0

$51.4

$47.3

Investment Multiple

2.86x

2.38x

2.09x

1.89x

1.74x

We target a base case return of 15.8% unleveraged IRR, $57 million of

cashflows and a 2.1x Loans

from

the

pools

refinanced

by

Nationstar

will

remain

within

the

pools

post

refinance

As recapture percentage increases, yield profile becomes less

sensitive to changes in prepayments In our base case, we

target a break-even CPR of 55% Transaction 2 –

Newcastle Targeted Returns

1)

Actual results may differ materially from base case returns.

Recapture ramp assumes 0% for 2 months after transfer date, 17% in month 3, and 35% thereafter. CPR ramp

assumes 30% to Dec 2014, 15% thereafter. Weighted average lifetime

uncollected payment of 10% (Uncollected payment 11% for Year 1 , 11% for Year 2). Recaptured loans

assume 10 CPR (8 CRR; 2 CDR); 35% Recapture; 25 yr loan term; 37.5

bps MSR; 4.00% WAC. 17

CPR

10%

15%

20%

25%

30%

IRR

22.6%

20.3%

18.5%

17.0%

15.6%

Cash Flows

$83.5

$72.3

$65.3

$60.2

$56.4

0% Recapture

35% Recapture (Base Case)

50% Recapture

(Cash Flows: $mm)

Recapture

mitigates

prepayment

risk

investment

multiple

–

assumes

20%

CPR

and

35%

recapture

rate

(1) |

18

Public Offering of Common Stock

3 |

Offering Summary

Issuer

Newcastle Investment Corp.

Exchange / Ticker

NYSE / NCT

Shares Offered

40,000,000 shares (100% primary)

Overallotment Amount

6,000,000 shares (15%)

Use of Proceeds

General corporate purposes, including Excess MSR acquisitions

Joint Bookrunners

Credit Suisse Securities (USA) LLC, Barclays Capital Inc., Citigroup

and UBS Securities LLC

Co-Managers

Keefe, Bruyette & Woods, Inc. and Macquarie Capital (USA)

Inc. 19 |