Exhibit 4.1

RESTRUCTURING SUPPORT AGREEMENT

This RESTRUCTURING SUPPORT AGREEMENT (together with all Exhibits, Annexes and Schedules hereto, in each case as amended, supplemented or otherwise modified from time to time, this “Support Agreement”) is dated as of September 3, 2013 by and among: (i) GateHouse Media, Inc. (“GateHouse”) and certain subsidiaries of GateHouse that are signatories hereto (collectively with GateHouse, the “GateHouse Parties”), (ii) Newcastle Investment Corp. (“Plan Sponsor”), (iii) each of the Participating Creditors (as defined below), and (iv) Cortland Products Corp. (formerly known as Gleacher Products Corp.), in its capacity as administrative agent under the Credit Agreement (as defined below) (each of the parties set forth in clauses (i) through (iv) above, a “Party”; collectively, the “Parties”).

WHEREAS, the Parties wish to effectuate a reorganization and restructuring of the GateHouse Parties (the “Transaction”) in accordance with a term sheet attached hereto as Exhibit A (the “Term Sheet”);

WHEREAS, the Parties anticipate that the Transaction will be effected through a prepackaged chapter 11 plan of reorganization; and

WHEREAS, in furtherance of the Transaction, the Parties have agreed to enter into this Support Agreement.

NOW, THEREFORE, in consideration of the foregoing and the promises, mutual covenants, and agreements set forth herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each Party, intending to be legally bound, agrees as follows:

Section 1. Definitions.

Capitalized terms used but not otherwise defined herein have the meanings ascribed to them in the Term Sheet, and if not defined there, in the Credit Agreement. As used in this Support Agreement, the following terms have the meanings specified below:

“Adequate Protection” means customary adequate protection granted to secured parties in chapter 11 cases of the size and type of the Chapter 11 Cases, including any adequate protection liens, superpriority administrative claims and current payment of reasonable legal counsel and financial advisor fees of the Administrative Agent, excluding the payment of post-petition interest.

“Administrative Agent” means Cortland Products Corp. (formerly known as Gleacher Products Corp.), in its capacity as administrative agent under the Credit Agreement.

“affiliate” means an “affiliate” as defined in Section 101(2) of the Bankruptcy Code.

“Bankruptcy Code” means title 11 of the United States Code, as amended.

“Bankruptcy Court” means the United States Bankruptcy Court for the District of Delaware.

“Bankruptcy Rules” means the Federal Rules of Bankruptcy Procedure as promulgated by the United States Supreme Court under section 2075 of title 28 of the United States Code, 28 U.S.C. § 2075, as applicable to the Chapter 11 Cases and the general, local and chambers rules of the Bankruptcy Court.

“Business Day” means any day (other than a Saturday or Sunday) on which banks are open for general business in New York City, New York.

“Chapter 11 Cases” means reorganization cases filed by the GateHouse Parties in accordance with and subject to the terms of this Support Agreement.

“Claims” means with respect to each Participating Creditor, such Participating Creditor’s claims (as defined in section 101(5) of the Bankruptcy Code) arising under the Credit Agreement and Swap Documents, against the GateHouse Parties set forth on such Participating Creditor’s signature page hereto or Creditor Joinder, as applicable and as may be acquired after the date of such signature page or Creditor Joinder, as applicable; provided that if there is any discrepancy in the principal amount of Loans set forth on a Participating Creditor’s signature page hereto and the principal amount of Loans held by such Participating Creditor as reflected in the Administrative Agent’s Register, the principal amount set forth on such Register shall be conclusive for purposes of this Support Agreement absent manifest error.

“Confirmation Order” means an order of the Bankruptcy Court entered on the docket in the Chapter 11 Cases, approving the Disclosure Statement and confirming the Plan, in form and substance reasonably satisfactory to the Administrative Agent, GateHouse Parties, and Plan Sponsor.

“Credit Agreement” means the Amended and Restated Credit Agreement, by and among certain affiliates of GateHouse, the Lenders and the Administrative Agent dated as of February 27, 2007, and the other Credit Documents (as defined therein)(in each case, as amended, supplemented or otherwise modified from time to time).

“Creditor Joinder” means a joinder to this Support Agreement, substantially in the form annexed hereto as Exhibit B.

“Creditors” means the Lenders and the Swap Counterparty.

“Disclosure Statement” means a disclosure statement to be provided to the Creditors relating to the Plan that complies with sections 1125 and 1126(b) of the Bankruptcy Code in form and substance reasonably satisfactory to the Majority Unaffiliated Participating Creditors.

“Fiduciary Out” has the meaning set forth in Section 7.14.

“First Day Motions” means motions seeking approval of (i) prepackaged plan scheduling procedures, and (ii) the Interim Cash Collateral Order and Final Cash Collateral Order (each as defined herein), which motions, applications and associated proposed orders shall be in form and substance reasonably satisfactory to the Majority Unaffiliated Participating Creditors.

“Investment Commitment Letter” means that certain Investment Commitment Letter dated as of September 3, 2013 by and among Plan Sponsor and the GateHouse Parties.

“Joining Creditor Party” means a (i) transferee of Claims that executes and delivers a Creditor Joinder to the Administrative Agent and the GateHouse Parties in connection with and at least five (5) Business Days prior to the relevant Transfer or (ii) Creditor that executes and delivers a Creditor Joinder to the Administrative Agent and the GateHouse Parties after the date hereof other than in connection with a Transfer.

2

“Lenders” means the several banks and other financial institutions from time to time parties to the Credit Agreement.

“Majority Unaffiliated Participating Creditors” means Unaffiliated Participating Creditors holding a majority in dollar amount of the Claims held by all Unaffiliated Participating Creditors, excluding any Creditor who has become a party to this Support Agreement but thereafter materially breaches this Support Agreement and fails to cure such breach within five (5) days following actual notice thereof, which breach has not been waived or otherwise cured pursuant to the terms hereof.

“Majority Participating Creditors” means, as of any date of determination, Participating Creditors holding a majority in dollar amount of the Claims held by all Participating Creditors, which Participating Creditors shall include the Majority Unaffiliated Participating Creditors, in each case excluding any Creditor who has become a party to this Support Agreement but thereafter materially breaches this Support Agreement and fails to cure such breach within five (5) days following actual notice thereof, which breach has not been waived or otherwise cured pursuant to the terms hereof.

“New Debt” means the Financing, if any (as defined in the Term Sheet), supported by the GateHouse Parties in the Chapter 11 Cases, that is on the same or better terms for New GateHouse than the Material Debt Terms (as defined in Exhibit D to the Term Sheet).

“Participating Creditors” means the Creditors who are original signatories now or subsequently become parties to this Support Agreement (including by the execution and delivery of a Creditor Joinder).

“Petition Date” means the date on which the Chapter 11 Cases are commenced.

“Person” means a “person” as defined in Section 101(41) of the Bankruptcy Code.

“Plan” means a joint, prepackaged chapter 11 plan of reorganization (including any exhibits, annexes and schedules thereto) for the GateHouse Parties that effectuates the Transaction, consistent with the terms of the Term Sheet and in form and substance reasonably satisfactory to the Majority Unaffiliated Participating Creditors, as it may be modified or supplemented in accordance with Section 7.13(c) of this Support Agreement.

“Plan Effective Date” means the date that is the first Business Day after the date of satisfaction or, subject to the prior written consent of Plan Sponsor and in consultation with the Administrative Agent, which consent may not be unreasonably withheld, waiver, of the conditions to effectiveness of the Plan as set forth therein.

“Qualified Marketmaker” means an entity that (i) holds itself out to the market as standing ready in the ordinary course of its business to purchase from customers and sell to customers claims against the GateHouse Parties (including debt securities or other debt) or enter with customers into long and short positions in claims against the GateHouse Parties (including debt securities or other debt), in its capacity as a dealer or market maker in such claims against the GateHouse Parties and (ii) is in fact regularly in the business of making a market in claims against issuers or borrowers (including debt securities or other debt).

3

“Requisite Participating Creditors” means “Requisite Participating Lenders” as defined in the Term Sheet.

“Requisite Threshold Date” means the first Business Day on which the Requisite Participating Creditors are and continue to be party to this Support Agreement (including by the execution and delivery of a Creditor Joinder), excluding any Creditor who has become a party to this Support Agreement but thereafter materially breaches this Support Agreement.

“Solicitation Commencement Date” means the date the GateHouse Parties (and/or a claims or solicitation agent on their behalf) first distributes the Disclosure Statement and ballots to the Creditors to solicit acceptances of the Plan from the Creditors, which Disclosure Statement and ballots shall be delivered to the Creditors by the Administrative Agent at the direction of GateHouse.

“Solicitation End Date” means 5.00 p.m. (prevailing Eastern time) on the second Business Day after the Solicitation Commencement Date, subject to extension by the Plan Sponsor in its sole discretion but in no event more than thirty (30) days without the written consent of the Majority Participating Creditors.

“Swap Counterparty” means Morgan Stanley Capital Services Inc.

“Swap Documents” means the 2002 Master Agreement, as published by the International Swaps and Derivatives Association, Inc. (together with the Schedule thereto) dated as of February 5, 2007 between Swap Counterparty and GateHouse Media Operating, Inc., together with (i) the Confirmation (as such term is defined in the Master Agreement) thereunder dated February 27, 2007, documenting a Transaction (as such term is defined in the Master Agreement) with a $100 million notional amount, (ii) the Confirmation thereunder dated April 4, 2007, documenting a Transaction with a $250 million notional amount, (iii) the Confirmation thereunder dated April 13, 2007, documenting a Transaction with a $200 million notional amount and (iv) the Confirmation thereunder dated September 18, 2007, documenting a Transaction with a $75 million notional amount.

“Termination Date” means the date of the occurrence of any Termination Event in accordance with its terms.

“Termination Event” means any event set forth in Section 3.1.

“Transfer” means, with respect to any Claim, the sale, participation, assignment or other transfer thereof.

“Unaffiliated Participating Creditors” means Participating Creditors other than Plan Sponsor, Fortress Investment Group LLC, and their respective affiliates.

The definitions of terms herein shall apply equally to the singular and plural forms of the terms defined. Whenever the context may require, any pronoun shall include the corresponding masculine, feminine and neuter forms. The words “include”, “includes” and “including” shall be deemed to be followed by the phrase “without limitation”. The word “will” shall be construed to have the same meaning and effect as the word “shall”. Unless the context requires otherwise (a) any reference herein to any Person shall be construed to include such Person’s successors and assigns, (b) the words “herein”, “hereof” and “hereunder”, and words of similar import, shall be

4

construed to refer to this Support Agreement in its entirety and not to any particular provision hereof and (c) all references herein to Sections, Exhibits, Annexes and Schedules shall be construed to refer to Sections of, and Exhibits, Annexes and Schedules to, this Support Agreement.

Section 2. Support of Transaction and Plan.

| (a) | Until the Termination Date, the GateHouse Parties, jointly and severally, agree to: |

| (i) | take any and all reasonably necessary and appropriate actions (including obtaining requisite corporate approvals) consistent with their obligations under this Support Agreement in furtherance of the Transaction and the confirmation and consummation of the Plan; |

| (ii) | take any and all reasonably necessary and appropriate actions to obtain executed signature pages to this Support Agreement; and |

| (iii) | provided that the Bankruptcy Threshold Creditors (as defined in the Term Sheet) have accepted the Plan by the Solicitation End Date, take any and all reasonably necessary and appropriate actions (including obtaining requisite corporate approvals) to (A) in conjunction with the distribution of the Disclosure Statement, solicit votes from Creditors to accept the Plan and (B) (i) commence the Chapter 11 Cases by filing voluntary petitions under the Bankruptcy Code in the Bankruptcy Court, (ii) file and seek approval on an interim and final (to the extent applicable) basis of customary and appropriate first day motions (including the First Day Motions), and (iii) file the Plan and Disclosure Statement with the Bankruptcy Court on the Petition Date and seek approval of the Disclosure Statement and confirmation of the Plan. |

| (b) | Until the Termination Date, each of the Participating Creditors, severally and not jointly, agrees to: |

| (i) | support and take any and all reasonably necessary and appropriate actions in furtherance of consummation of the Transaction and this Support Agreement; |

| (ii) | subject to receipt of the Disclosure Statement and solicitation in accordance with sections 1125 and 1126 of the Bankruptcy Code and subject to Section 6 hereof, (x) (1) deliver its duly-completed ballot(s) for receipt (at the address specified therein) by the Solicitation End Date in order to vote its Claims to accept the Plan and elect treatment under the Plan with respect to its Claims for the Cash-Out Option and/or the New Media Equity Option consistent with the election indicated in its signature page or Creditor Joinder hereto, and (2) with respect to voting of any claim held by a Participating Creditor for trades not settled (but which claims will be bound by the terms hereof upon the closing of such trade), to direct the delivery of duly-completed ballot(s) for receipt (at the address specified therein) by the Solicitation End Date in order for the vote of such claims to accept the Plan; (y) not mark its ballot(s) to |

5

| indicate its refusal to grant the releases provided for in the Plan; and (z) not change or withdraw (or cause to be changed or withdrawn) such vote, unless the Plan is modified in a manner not permitted under this Support Agreement; and |

| (iii) | (A) support approval of the Disclosure Statement and confirmation of the Plan (and not object to approval of the Disclosure Statement or confirmation of the Plan, or support the efforts of any other Person to oppose or object to, approval of the Disclosure Statement or confirmation of the Plan), unless the Plan is modified in a manner not permitted under this Support Agreement, (B) support (and not object to or support the efforts of any other Person to oppose or object to) the First Day Motions, (C) support approval of the New Debt, if any (and not object to or support the efforts of any other Person to oppose or object to the New Debt, if any), (D) refrain from taking any action not required by law that is inconsistent with, or that would materially delay or impede approval, confirmation or consummation of the Plan or that is otherwise inconsistent with the express terms of this Support Agreement or the Term Sheet, unless such action is taken in response to an action taken by a GateHouse Party that is in breach of the terms of this Support Agreement, (E) not, directly or indirectly, propose, support, solicit, encourage, or participate in the formulation of any plan of reorganization or liquidation in the Chapter 11 Cases other than the Plan, and (F) not, directly or indirectly, file, support, solicit, encourage, or consent to any motion in the Chapter 11 Cases seeking to terminate any GateHouse Party’s exclusive right to file a plan of reorganization pursuant to section 1121 of the Bankruptcy Code. |

| (c) | Until the Termination Date, and without limiting its other agreements under Section 2(b), Plan Sponsor agrees to perform its obligations under, and not terminate in any respect, the Investment Commitment Letter, subject to the terms and conditions thereunder. |

For the avoidance of doubt, each of the Parties also agrees, severally and not jointly, that, until the Termination Date, it will not take any action (or refrain from taking an action) that, directly or indirectly, would in any material respect interfere with, delay, impede, or postpone or take any other action that interferes with, the implementation of the Transaction and confirmation and consummation of the Plan.

Section 3. Termination.

3.1 Termination Events.

| (a) | Termination After Breach. Subject to the immediately succeeding sentence, this Support Agreement, and the obligations of all Parties hereunder shall terminate ten (10) Business Days after receipt of written notice given by any GateHouse Party, Plan Sponsor or the Majority Unaffiliated Participating Creditors of a material breach of any of the undertakings, representations, warranties or covenants of this Support Agreement by any Participating Creditor (in the case of notice from any GateHouse Party), the Plan Sponsor (in the case of notice from the Majority Unaffiliated Participating Creditors) or any GateHouse Party (in the |

6

| case of notice from Plan Sponsor or the Majority Unaffiliated Participating Creditors), and such breach shall not have been cured or waived by the applicable Parties in the ten (10) Business Day period after the receipt by the Participating Creditors, Plan Sponsor or the GateHouse Parties, as the case may be, of such notice (it being understood that the Parties’ obligations under Section 2 shall be deemed material in all events). If any Unaffiliated Participating Creditor shall breach its undertakings, representations, warranties or covenants under this Support Agreement, the Termination Event arising as a result of such act or omission shall apply only to such Unaffiliated Participating Creditor, and this Support Agreement shall otherwise remain in full force and effect with respect to the GateHouse Parties, the Plan Sponsor and all other Participating Creditors. |

| (b) | Automatic Termination After Specified Events. This Support Agreement, and the obligations of all Parties hereunder, shall be immediately and automatically terminated upon the occurrence of any of the following events: |

(1) on the date on which any of the Chapter 11 Cases shall be dismissed or converted to a chapter 7 case, or a chapter 11 trustee, a responsible officer, or an examiner with enlarged powers relating to the operation of the businesses of any of the GateHouse Parties (powers beyond those set forth in Section 1106(a)(3) and (4) of the Bankruptcy Code) shall be appointed in any of the Chapter 11 Cases or any of the GateHouse Parties shall file a motion or other request for any such relief;

(2) the date on which any GateHouse Parties, by written notice to Plan Sponsor and the Participating Creditors, shall have elected to terminate this Support Agreement in exercise of the Fiduciary Out; or

(3) the earlier of (A) December 16, 2013, and (B) the Plan Effective Date.

| (c) | Termination by Plan Sponsor or Majority Unaffiliated Participating Creditors After Other Events. This Support Agreement, and the obligations of all Parties hereunder, may be terminated by Plan Sponsor or the Majority Unaffiliated Participating Creditors, ten (10) Business Days after the GateHouse Parties’ receipt of written notice that any of the following events has occurred and is continuing, if such event has not been cured by the GateHouse Parties or waived by the Party giving such notice within such ten (10) Business Day period: |

(1) upon the commencement of any of the Chapter 11 Cases prior to the Solicitation Commencement Date;

(2) upon the entry of any order in the Chapter 11 Cases terminating any GateHouse Party’s exclusive right to file a plan of reorganization pursuant to section 1121 of the Bankruptcy Code;

(3) on the fifteenth (15th) Business Day after the Requisite Threshold Date, unless prior thereto the Solicitation Commencement Date has occurred;

(4) provided that the Bankruptcy Threshold Creditors (as defined in the Term Sheet) have accepted the Plan by the Solicitation End Date, on the fifth (5th) Business Day after the Solicitation End Date unless prior thereto the Chapter 11 Cases have been commenced;

7

(5) the failure of the GateHouse Parties to file the Plan and the Disclosure Statement with the Bankruptcy Court on the Petition Date;

(6) the failure of the Bankruptcy Court, subject to the Bankruptcy Court’s schedule, to enter in the Chapter 11 Cases (A) within three (3) Business Days after the Petition Date, an interim order (the “Interim Cash Collateral Order”), and (B) on or prior to the thirtieth (30th) Business Day after the Petition Date (unless the Plan Effective Date has occurred), a final order (the “Final Cash Collateral Order”), in form and substance reasonably satisfactory to the GateHouse Parties, the Administrative Agent and the Majority Unaffiliated Participating Creditors, authorizing the GateHouse Parties to use the cash collateral of, and granting Adequate Protection to, the Administrative Agent and the Creditors, and, in the case of the interim order, scheduling a final hearing pursuant to Bankruptcy Rule 4001(B);

(7) the failure of the Bankruptcy Court, subject to the Bankruptcy Court’s schedule, to enter in the Chapter 11 Cases (A) within three (3) Business Days after the Petition Date, an interim order, and (B) on or prior to the thirtieth (30th) Business Day after the Petition Date (unless the Plan Effective Date has occurred), a final order, in form and substance reasonably satisfactory to the GateHouse Parties, Plan Sponsor, and the Majority Participating Creditors, approving the GateHouse Parties’ cash management systems;

(8) if any GateHouse Party’s consensual use of the Administrative Agent’s and Creditors’ cash collateral is terminated in accordance with an Interim Cash Collateral Order or Final Cash Collateral Order entered in the Chapter 11 Cases as required pursuant to Section 3.1(c)(6);

(9) the sixtieth (60th) Business Day after the Petition Date, unless prior thereto the Bankruptcy Court has entered the Confirmation Order, subject to the Bankruptcy Court’s schedule;

(10) the GateHouse Parties take any of the following actions: (A) withdraw the Plan, (B) publicly announce their intention not to proceed with the Plan, or (C) file any motion, pleading, plan of reorganization (if not substantially in the form of the Plan) and/or disclosure statement (if not substantially in the form of the Disclosure Statement) that (x) is materially inconsistent with any material provision of the Term Sheet or (y) materially adversely affects the rights of the Party (or Parties) seeking to terminate this Support Agreement; provided, however, that the refusal of the Bankruptcy Court to include in the order confirming the Plan a release and exculpation of the Creditor included in the Term Sheet shall not constitute an adverse effect;

(11) the Bankruptcy Court grants relief that (x) is materially inconsistent with any material provision of the Term Sheet or (y) materially adversely affects the rights of the Party (or Parties) seeking to terminate this Support Agreement; provided, however, that the refusal of the Bankruptcy Court to include in the order confirming the Plan a release and exculpation of the Creditor included in the Term Sheet shall not constitute an adverse effect;

8

(12) either (1) a filing by any GateHouse Party of any motion, application or adversary proceeding challenging the validity, enforceability, perfection or priority of, or seeking avoidance or subordination of, the Obligations (as defined in the Credit Agreement) or the liens securing the Obligations or asserting any other cause of action against and/or with respect to the Obligations, the prepetition liens securing the Obligations, the Administrative Agent or any of the Participating Creditors (or if any GateHouse Party supports any such motion, application or adversary proceeding commenced by any third party or consents to the standing of any such third party), or (2) the entry of an order of the Bankruptcy Court granting relief with respect to any of the foregoing claims or causes of action;

(13) the Investment Commitment Letter has terminated or ceased to be in full force and effect;

(14) on the date on which any court of competent jurisdiction or other competent governmental or regulatory authority issues a ruling or an order restricting any material aspect of the Transaction in a manner materially adverse to Plan Sponsor or the Participating Creditors.

3.2 Effect of Termination; Termination Event Procedures.

Each of the GateHouse Parties hereby agrees that the automatic stay arising pursuant to section 362 of the Bankruptcy Code in the event the Chapter 11 Cases are commenced shall be deemed waived or modified for purposes of providing notice or exercising rights hereunder.

Upon the Termination Date, any and all votes with respect to the Plan prior to such Termination Date shall be automatically and immediately withdrawn, and such votes shall be deemed to be null and void for all purposes and shall not be considered or otherwise used in any manner by the Parties; provided that within five (5) Business Days after the Termination Date any Participating Creditor on behalf of itself, may advise the GateHouse Parties in writing (with a copy to the Plan Sponsor and the Administrative Agent) that such Participating Creditor’s ballot, and signature page or Creditor Joinder hereto, continue to be effective and are not withdrawn.

Section 4. Representations, Warranties and Covenants.

4.1 Power and Authority.

Each Participating Creditor, severally and not jointly, Plan Sponsor and each of the GateHouse Parties, jointly and severally, represents, warrants and covenants that, as of the date hereof, (i) such Party has and shall maintain all requisite corporate, partnership, or limited liability company power and authority to enter into this Support Agreement, and (ii) the execution and delivery of this Support Agreement, and the performance of its obligations hereunder have been duly authorized by all necessary action on its part.

9

4.2 Enforceability.

Each Participating Creditor, severally and not jointly, Plan Sponsor, and each of the GateHouse Parties, jointly and severally, represents, warrants and covenants that this Support Agreement is the legally valid and binding obligation of it, enforceable in accordance with its terms, except as enforcement may be limited by bankruptcy, insolvency, reorganization or other similar laws limiting creditors’ rights generally or by equitable principles relating to enforceability.

4.3 Governmental Consent; No Conflicts.

Each of the GateHouse Parties, jointly and severally, represents, warrants and covenants that, as of the date hereof, the execution, delivery, and performance by it of this Support Agreement (a) does not and shall not require any registration or filing with, consent or approval of, or notice to, or other action to, with, or by, any Federal, state, or other governmental authority or regulatory body, except (i) such filings as may be necessary and/or required for disclosure by the SEC and applicable state securities or “blue sky” laws and (ii) any filings in connection with the Chapter 11 Cases, including the approval of the Disclosure Statement and confirmation of the Plan and (b) will not violate any applicable law or regulation or the charter, limited liability company agreement, by-laws or other organizational documents of any of the GateHouse Parties or any order of any governmental authority.

4.4 Ownership.

Each Participating Creditor, severally and not jointly, represents, warrants and covenants that:

| (a) | such Participating Creditor is the owner of the Claims set forth as “Owned Claims” on its signature page hereto or set forth on the schedule attached to its Creditor Joinder (as applicable), or has and shall maintain the power and authority to bind the legal and beneficial owner(s) of such Claims to the terms of this Support Agreement; |

| (b) | such Participating Creditor (i) has and shall maintain full power and authority to vote on and elect treatment under the Plan with respect to the Claims set forth as “Voting Claims” on its signature page hereto or set forth on the schedule attached to its Creditor Joinder (as applicable) and execute and deliver its signature pages to this Support Agreement or (ii) has received direction from the party having full power and authority to vote on and elect treatment under the Plan with respect to such Claims and execute and deliver its signature pages to this Support Agreement; |

| (c) | other than as permitted under this Support Agreement, such Claims are and shall continue to be free and clear of any pledge, lien, security interest, charge, claim, equity, option, proxy, voting restriction, right of first refusal or other limitation on disposition, or encumbrances of any kind, that would adversely affect in any way such Participating Creditor’s performance of its obligations under this Support Agreement at the time such obligations are required to be performed; and |

| (d) | such Participating Creditor has made no prior Transfer, and has not entered into any other agreement to assign, sell, participate, grant, convey or otherwise transfer, in whole or in part, any portion of its right, title, or interest in any |

10

| Claims held by such Participating Creditor as of the date hereof that are inconsistent with, or in violation of, the representations and warranties of such Participating Creditor herein, in violation of its obligations under this Support Agreement or that would adversely affect in any way such Participating Creditor’s performance of its obligations under this Support Agreement at the time such obligations are required to be performed. |

Section 5. Remedies.

The Parties agree that any breach of this Support Agreement would give rise to irreparable damage for which monetary damages would not be an adequate remedy. Each Party accordingly agrees that the Parties will be entitled to (a) enforce the terms of this Support Agreement by decree of specific performance and (b) obtain injunctive relief against any breach or threatened breach, in each case without the necessity of proving actual damages, proving the inadequacy of monetary damages as a remedy or posting or securing any bond in connection with such specific performance or injunctive relief. The Parties agree that such relief will be their only remedy against the applicable other Party with respect to any such breach, and that in no event will any Party be liable for monetary damages.

Section 6. Acknowledgments.

This Support Agreement is the product of negotiations among the Parties, together with their respective representatives. Notwithstanding anything herein to the contrary, this Support Agreement is not, and shall not be deemed to be, a solicitation of votes for the acceptance of the Plan or any plan of reorganization for the purposes of sections 1125 and 1126 of the Bankruptcy Code or otherwise. The GateHouse Parties will not solicit acceptances of the Plan from any Participating Creditor until such Participating Creditor has been provided with a copy of the Disclosure Statement. Furthermore, no securities of any GateHouse Party are being offered or sold hereby and this Support Agreement neither constitutes an offer to sell nor a solicitation of an offer to buy any securities of any GateHouse Party.

Section 7. Miscellaneous Terms.

7.1 Assignment; Transfer Restrictions.

| (a) | Each Participating Creditor hereby agrees, severally and not jointly, for so long as this Support Agreement shall remain in effect as to it, not to Transfer any of its Claims, or convey, grant, issue or sell any option or right to acquire any of its Claims or voting rights related thereto or any other interest in any Claim against the GateHouse Parties, except to (i) a party that is a Participating Creditor or (ii) a Joining Creditor Party; provided that any such Claims shall automatically be deemed to be subject to the terms of this Support Agreement. As a condition to the effectiveness of any such Transfer, each Joining Creditor Party shall indicate, on the signature page to its Creditor Joinder, the amount of Claims held by such Joining Creditor Party. With respect to any Transfer effectuated in accordance with this Section 7.1(a), such Joining Creditor Party shall be deemed to be a Participating Creditor for purposes of this Support Agreement. For the avoidance of doubt, any sale of participations (under Section 9.6(b) of the Credit Agreement) by a Participating Creditor of all or a portion of such Participating Creditor’s rights or obligations under the Credit Agreement (including all or a portion of the Loans owing to such Participating Creditor) shall not relieve such |

11

| Participating Creditor from its obligations under this Support Agreement, including with respect to any such participation (regardless of any instruction a transferee of such participation gives with respect to voting or any other rights and obligations of the Participating Creditor hereunder), to which such Participating Creditor shall remain bound subject to the terms hereof. |

| (b) | Any purported Transfer or transaction involving any Claim that does not comply with the procedures set forth in Section 7.1(a) shall be deemed void ab initio. |

| (c) | This Support Agreement shall not preclude any Participating Creditor from acquiring additional Claims; provided that any such Claims shall automatically be deemed to be “Claims” of such Participating Creditor subject to the terms of this Support Agreement. |

| (d) | Notwithstanding anything herein to the contrary, (1) a Participating Creditor may Transfer or participate any right, title or interest in Claims to an entity that is acting in its capacity as a Qualified Marketmaker (a “Transfer to a QMM”) without the requirement that the Qualified Marketmaker be or become a Participating Creditor, provided that such Transfer to a QMM shall only be valid if the Qualified Marketmaker subsequently Transfers or participates such right, title or interest in the Claims to a transferee who is a Participating Creditor (or becomes a Participating Creditor at the time of the Transfer or participation pursuant to a Creditor Joinder) either (i) prior to the voting record date for the Plan (the “Voting Record Date”) if the Transfer to a QMM is made prior to the Voting Record Date or (ii) after the Voting Record Date if the Transfer to a QMM is made after the Voting Record Date, and (2) if a Participating Creditor, acting in its capacity as a Qualified Marketmaker, acquires a right, title or interest in Claims from a holder of Claims who is not a Participating Creditor, it may Transfer or participate such Claims without the requirement that the transferee be or become a Participating Creditor. |

7.2 No Third Party Beneficiaries.

This Support Agreement shall be solely for the benefit of the GateHouse Parties, Plan Sponsor, the Administrative Agent, and each Participating Creditor. No Person shall be a third party beneficiary of this Support Agreement.

7.3 Entire Agreement.

This Support Agreement, including the Term Sheet, Schedules and Exhibits, constitutes the entire agreement of the Parties with respect to the subject matter of this Support Agreement, and supersedes all other prior negotiations, agreements, and understandings, whether written or oral, among the Parties with respect to the subject matter of this Support Agreement.

7.4 Counterparts.

This Support Agreement may be executed in one or more counterparts, each of which shall be deemed an original and all of which shall constitute one and the same agreement. Delivery of an executed signature page of this Support Agreement by electronic transmission shall be effective as delivery of a manually executed counterpart hereof.

12

7.5 Settlement Discussions.

This Support Agreement (including the Term Sheet) is the product of negotiations among the Parties hereto and reflects various agreements and compromises to implement the Transaction. Nothing herein shall be deemed to be an admission of any kind. Pursuant to Federal Rule of Evidence 408 and any applicable state rules of evidence, this Support Agreement and all negotiations relating hereto shall not be admissible into evidence in any proceeding other than a proceeding to enforce the terms of this Support Agreement; provided, however, that the GateHouse Parties shall be permitted to file a copy of this Support Agreement in connection with the Chapter 11 Cases.

7.6 Continued Banking Practices.

Notwithstanding anything herein to the contrary, each Participating Creditor and its affiliates may accept deposits from, lend money to, and generally engage in any kind of banking, investment banking, trust or other business with, or provide debt financing (including debtor in possession financing), equity capital or other services (including financial advisory services) to any GateHouse Party or any affiliate of any GateHouse Party or any other Person, including, but not limited to, any Person proposing or entering into a transaction related to or involving any GateHouse Party or any affiliate thereof.

7.7 Business Continuance.

Except as contemplated by this Support Agreement or with the consent of the Majority Participating Creditors, the GateHouse Parties covenant and agree that, between the date hereof and the Plan Effective Date, the GateHouse Parties shall operate their businesses in the ordinary course in a manner consistent with past practice in all material respects (other than any changes in operations (i) resulting from or relating to the Plan or the proposed or actual filing of the Chapter 11 Cases or (ii) imposed by the Bankruptcy Court).

7.8 Reservation of Rights; Events of Default; Waivers; Amendments.

Except as expressly provided in this Support Agreement, nothing herein is intended to, shall or shall be deemed in any manner to (i) waive, limit, impair, prejudice or restrict the ability of the Administrative Agent or each Participating Creditor to protect and preserve its rights, remedies and interests, including, but not limited to, all of its rights and remedies, whether now existing or arising in the future, under the Credit Agreement, the other Credit Documents, any other instrument or agreement referred to herein or therein, the Bankruptcy Code or applicable law, including any such rights and remedies relating to Defaults or other events that may have occurred prior to the execution of this Support Agreement, any and all of its claims and causes of action against any of the GateHouse Parties, any liens or security interests it may have in any assets of any of the GateHouse Parties or any third parties, or its full participation in the Chapter 11 Cases, if commenced, (ii) constitute an amendment, modification or forbearance by the Administrative Agent or the Lenders with respect to (x) any other term, provision, condition, Default or Event of Default of or under the Credit Agreement or any of the other Credit Documents, or (y) any other instrument or agreement referred to herein or therein and (iii) limit or impair the ability of the Administrative Agent or any of the Participating Creditors to consult with each other or the GateHouse Parties. If the Transaction is not consummated as provided herein or if a Termination Date occurs, the Administrative Agent, the Participating Creditors and the GateHouse Parties each fully reserve any and all of their respective rights, remedies and interests under the Credit Documents and applicable law and in equity, except as provided in the last sentence of Section 3.2.

13

Notwithstanding the foregoing, the Parties agree that negotiation of, entry into, and performance by the GateHouse Parties of their obligations under this Support Agreement shall not be deemed to constitute a Default or Event of Default of or under the Credit Agreement or any of the other Credit Documents.

7.9 Administrative Agent.

The Participating Creditors (constituting Required Lenders under the Credit Agreement) hereby authorize and direct the Administrative Agent to take all actions required of the Administrative Agent under this Support Agreement. Notwithstanding anything herein to the contrary, the terms of this Support Agreement shall not be construed so as to limit the ability of the Administrative Agent (in its sole discretion and solely in its capacity as Administrative Agent) from exercising its duties or obligations under the Credit Agreement or related agreements.

7.10 Governing Law; Waiver of Jury Trial.

| (a) | The Parties waive all rights to trial by jury in any jurisdiction in any action, suit, or proceeding brought to resolve any dispute under or arising out of or in connection with this Support Agreement, whether sounding in contract, tort or otherwise. |

| (b) | This Support Agreement shall be governed by and construed in accordance with the internal laws of the State of New York. By its execution and delivery of this Support Agreement, each Party hereby irrevocably and unconditionally agrees for itself that, subject to Section 7.10(c), any legal action, suit or proceeding against it with respect to any matter under or arising out of or in connection with this Support Agreement or for recognition or enforcement of any judgment rendered in any such action, suit or proceeding, may be brought in any state or federal court of competent jurisdiction in New York County, State of New York, and by execution and delivery of this Support Agreement, each of the Parties hereby irrevocably accepts and submits itself to the nonexclusive jurisdiction of such court, generally and unconditionally, with respect to any such action, suit or proceedings. |

| (c) | Notwithstanding the foregoing, if the Chapter 11 Cases are commenced, nothing in Sections 7.10(a) or 7.10(b) shall limit the authority of the Bankruptcy Court to hear any matter under or arising out of or in connection with this Support Agreement. Further, if the Chapter 11 Cases are commenced, each of the Parties hereby irrevocably and unconditionally agrees for itself that (i) any legal action, suit or proceeding against it with respect to any matter under this Support Agreement or for recognition or enforcement of any judgment rendered in any such action, suit or proceeding, shall be brought in the Bankruptcy Court, and (ii) it accepts and submits itself to the exclusive jurisdiction of the Bankruptcy Court, generally and unconditionally, with respect to any such action, suit or proceeding, and waives any objection it may have to venue or the convenience of the forum. |

14

7.11 Successors.

This Support Agreement is intended to bind the Parties and inure to the benefit of, and be binding upon the Participating Creditors and each of the GateHouse Parties and their respective successors, permitted assigns, heirs, executors, administrators and representatives.

7.12 Acknowledgment Regarding Counsel.

Each of the Parties acknowledges that it has been represented by counsel (or had the opportunity to and waived its right to do so) in connection with this Support Agreement and the transactions contemplated by this Support Agreement. Accordingly, any rule of law or any legal decision that would provide any Party with a defense to the enforcement of the terms of this Support Agreement against such Party based upon lack of legal counsel shall have no application and is expressly waived. No Party shall have any term or provision construed against such Party solely by reason of such Party having drafted the same.

7.13 Modifications, Amendments, Waivers.

| (a) | This Support Agreement (including the exhibits and schedules hereto) may only be modified or amended, and any of the terms hereof (including in Section 3.1 hereof) may only be waived, by an agreement in writing signed by each of the GateHouse Parties, Plan Sponsor, and the Majority Unaffiliated Participating Creditors; provided, further, that any modification, amendment, or waiver that adversely affects the rights of the Administrative Agent shall require the written consent of the Administrative Agent. |

| (b) | The definition of “Requisite Participating Creditors,” “Majority Participating Creditors,” “Majority Unaffiliated Participating Creditors,” or “Unaffiliated Participating Creditors,” and this Section 7.13, may not be modified, amended or supplemented, or any of its terms waived, as applicable, without the prior written consent of each Participating Creditor |

| (c) | The Plan may be modified or amended by the GateHouse Parties, provided that the written consent of Plan Sponsor and the Majority Unaffiliated Participating Creditors, as applicable, shall be required for any such modification or amendment that (x) is materially inconsistent with any material provision of the Term Sheet or (y) materially adversely affects the rights of Plan Sponsor or the Majority Unaffiliated Participating Creditors, as applicable; provided that (1) any modification, amendment, or waiver that adversely affects the rights of the Administrative Agent shall require the written consent of the Administrative Agent; provided, further, that the refusal of the Bankruptcy Court to include in the order confirming the Plan a release and exculpation of the Creditors and/or the Administrative Agent shall not constitute an adverse effect. |

7.14 Fiduciary Duties.

Notwithstanding anything to the contrary herein, nothing in this Support Agreement shall require GateHouse, any of the other GateHouse Parties, or any of their respective directors or officers (in such Person’s capacity as a director or officer) to take any action, or to refrain from taking any action, to the extent that taking such action or refraining from taking such action would be inconsistent with such Person’s fiduciary obligations under applicable law (the rights of the GateHouse Parties and their respective directors and officers under this Section 7.14, the “Fiduciary Out”).

15

7.15 Further Assurances; Rule of Construction.

Subject to the other terms of this Support Agreement, the Parties agree to execute and deliver such other instruments and perform such acts, in addition to the matters herein specified, as may be reasonably appropriate or necessary, from time to time, to effectuate the Transaction. For purposes of computing days under this Support Agreement, (a) the day of the event triggering the period shall be excluded; (b) every day, including intermediate non-Business Days shall be included; and (c) the last day of the period shall be included, provided that if the last day of the period is a non-Business Day, the period shall continue to run until the immediately succeeding Business Day from such last day of the period. For the avoidance of doubt, execution of this Support Agreement by the Agent shall not be a condition to or otherwise affect the effectiveness of this Support Agreement or the obligations of the other Parties hereunder.

7.16 Severability of Provisions.

If any provision of this Support Agreement for any reason is held to be invalid, illegal or unenforceable in any respect, that provision shall not affect the validity, legality or enforceability of any other provision of this Support Agreement.

7.17 Notices.

All notices and other communications required or permitted hereunder shall be in writing and shall be deemed given when: (a) delivered personally or by overnight courier to the following address of the applicable other Party hereto; or (b) sent by fax to the following fax number of such other Party hereto with the confirmatory copy delivered by overnight courier to the address of such other Party listed below.

If to the GateHouse Parties, to:

GateHouse Media, Inc.

350 WillowBrook Office Park

Fairport, New York 14450

Attention: Michael Reed

Attention: Polly Sack

Facsimile: (585) 248-2631

with a copy to:

Young Conaway Stargatt & Taylor, LLP

Rodney Square

1000 North King Street

Wilmington, DE 19801

Attention: Pauline K. Morgan

Attention: Joel A. Waite

Facsimile: (302) 571-1253

16

If to Plan Sponsor, to:

Newcastle Investment Corp.

c/o FIG LLC

1345 Avenue of the Americas

46th Floor

New York, New York 10150

Attention: Cameron MacDougall

Facsimile: (917) 591-8312

with a copy to:

Cleary Gottlieb Steen & Hamilton LLP

One Liberty Plaza

New York, NY 10006

Attention: James L. Bromley

Attention: Sean A. O’Neal

Facsimile: (212) 225-3999

If to any Participating Creditor, the address set forth on its signature page.

with a copy to:

Milbank, Tweed, Hadley & McCloy LLP

601 S. Figueroa St.

Los Angeles, CA 90017

Attention: Brett Goldblatt

Attention: Mark Shinderman

(213) 892-4000

If to the Administrative Agent, the address set forth on its signature page.

with a copy to:

Milbank, Tweed, Hadley & McCloy LLP

601 S. Figueroa St.

Los Angeles, CA 90017

Attention: Brett Goldblatt

Attention: Mark Shinderman

(213) 892-4000

[SIGNATURE PAGES FOLLOW]

17

In witness whereof, the Parties hereto have caused this Support Agreement to be duly executed by their respective authorized officers as of the day and year first above written.

| GATEHOUSE MEDIA, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA INTERMEDIATE HOLDCO, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA HOLDCO, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA OPERATING, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA MASSACHUSETTS I, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA MASSACHUSETTS II, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

[Signature Page to Support Agreement]

| ENHE ACQUISITION, LLC, a Delaware limited liability company | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA DIRECTORIES HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA VENTURES, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA ARKANSAS HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA CALIFORNIA HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA COLORADO HOLDINGS, INC, a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

19

| GATEHOUSE MEDIA CORNING HOLDINGS, INC., a Nevada corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA FREEPORT HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA ILLINOIS HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA IOWA HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA KANSAS HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA LANSING PRINTING, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

20

| GATEHOUSE MEDIA LOUISIANA HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA MANAGEMENT SERVICES, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA MICHIGAN HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA MINNESOTA HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA MISSOURI HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA NEBRASKA HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

21

| GATEHOUSE MEDIA NEVADA HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA NEW YORK HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA NORTH DAKOTA HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA PENNSYLVANIA HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA SUBURBAN NEWSPAPERS INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| LIBERTY SMC, L.L.C., a Delaware limited liability company | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

22

| MINERAL DAILY NEWS TRIBUNE, INC., a West Virginia corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| NEWS LEADER, INC., a Louisiana corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| TERRY NEWSPAPERS, INC., an Iowa corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| ENTERPRISE NEWSMEDIA HOLDING, LLC, a Delaware limited liability company | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| ENTERPRISE NEWSMEDIA, LLC, a Delaware limited liability company | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| LRT FOUR HUNDRED, LLC, a Delaware limited liability company | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

23

| GEORGE W. PRESCOTT PUBLISHING COMPANY, LLC, a Delaware limited liability company | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| LOW REALTY, LLC, a Delaware limited liability company | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| ENTERPRISE PUBLISHING COMPANY, LLC, a Delaware limited liability company | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| SUREWEST DIRECTORIES, a California corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| COPLEY OHIO NEWSPAPERS, INC., an Illinois corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| THE PEORIA JOURNAL STAR, INC., an Illinois corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

24

| GATEHOUSE MEDIA CONNECTICUT HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA DELAWARE HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA FLORIDA HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA ILLINOIS HOLDINGS II, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA KANSAS HOLDINGS II, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA MICHIGAN HOLDINGS II, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

25

| GATEHOUSE MEDIA MISSOURI HOLDINGS II, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA NEBRASKA HOLDINGS II, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA OHIO HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA OKLAHOMA HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

| GATEHOUSE MEDIA TENNESSEE HOLDINGS, INC., a Delaware corporation | ||

| By: | /s/ Michael E. Reed | |

| Name: | Michael E. Reed | |

| Title: | Chief Executive Officer | |

26

| NEWCASTLE INVESTMENT CORP., As Plan Sponsor | ||

| By: | /s/ Kenneth Riis | |

| Name: | Kenneth Riis | |

| Title: | Chief Executive Officer | |

[Signature Page to Support Agreement]

| CORTLAND PRODUCTS CORP. | ||

| By: |

||

| Name: | ||

| Title: | ||

| Notice Address: |

28

| [PARTICIPATING LENDER], | ||

| as a Participating Creditor | ||

| By: | ||

| Name: |

||

| Title: |

||

| Notice Address: |

| |

OWNED CLAIMS UNDER CREDIT AGREEMENT

| Lender |

Amount of Claim under Credit Agreement | |

Plan Treatment Election with Respect to Owned Claims:

% of Claims Elected for Cash-Out Option (as defined in the Term Sheet)

% of Claims Elected for New Media Equity Option (as defined in the Term Sheet)

(Percentages above must add to 100%)

VOTING CLAIMS UNDER CREDIT AGREEMENT

| Lender |

Amount of Claim under Credit Agreement | |

Plan Treatment Election with Respect to Voting Claims:

% of Claims Elected for Cash-Out Option

% of Claims Elected for New Media Equity Option

(Percentages above must add to 100%)

29

EXHIBIT A

TERM SHEET

[Signature Page to Support Agreement]

GateHouse Media, Inc.

and certain of its direct or indirect subsidiaries

Restructuring Term Sheet

Summary of Terms and Conditions

This term sheet (including all exhibits hereto, the “Term Sheet”) summarizing terms of potential transactions (the “Restructuring”) concerning GateHouse Media, Inc. (“GateHouse” or the “Company”) is not a complete list of all the terms and conditions of the potential transactions described herein. This Term Sheet shall not constitute an offer to sell or buy, nor the solicitation of an offer to sell or buy any of the securities referred to herein or the solicitation of acceptances of a chapter 11 plan. Any such offer or solicitation shall only be made in compliance with all applicable laws. Without limiting the generality of the foregoing, this Term Sheet and the undertakings contemplated herein are subject in all respects to the negotiation, execution and delivery of definitive documentation, and the approval by a special committee of the board of directors of the Company that has been established to evaluate strategic alternatives for the Company. This Term Sheet is intended to be attached to, and incorporated into, a restructuring support agreement (the “Restructuring Support Agreement”) to be executed by certain of the Debtors’ creditors that are signatories thereto, including a certain steering committee (the “Steering Committee”) of lenders under the Amended and Restated Credit Agreement, dated as of February 27, 2007, as amended (the “2007 Credit Facility”). For purposes of this Term Sheet, (a) the term “Requisite Participating Lenders” shall be defined as the creditors that hold at least 67% of the aggregate amount of outstanding claims under the 2007 Credit Facility and the Debtors’ outstanding swap agreements (“Swap Liability”) as necessary for acceptance of a plan of reorganization under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) and (b) the term “Majority Unaffiliated Participating Creditors” has the meaning set forth in the Restructuring Support Agreement to which this Term Sheet is attached. The potential use of chapter 11 of the Bankruptcy Code to implement the Restructuring is not, and shall not be considered by any recipient of this Term Sheet to be, an admission that the Company or its subsidiaries are or will become insolvent or are otherwise unable to satisfy their debts as they come due. This Term Sheet constitutes confidential information pursuant to the 2007 Credit Facility and may not be disclosed to any other person except as permitted thereunder. This Term Sheet is proffered in the nature of a settlement proposal in furtherance of settlement discussions pursuant to Federal Rule of Evidence 408 and any other rule of similar import.

EXCEPT AS EXPRESSLY STATED HEREIN, THIS TERM SHEET IS BEING PROVIDED AS PART OF A PROPOSED COMPREHENSIVE RESTRUCTURING TRANSACTION, EACH ELEMENT OF WHICH IS CONSIDERATION FOR THE OTHER ELEMENTS AND AN INTEGRAL ASPECT OF THE PROPOSED RESTRUCTURING OF THE OUTSTANDING DEBT (AS DEFINED BELOW). NOTHING IN THIS TERM SHEET SHALL CONSTITUTE OR BE CONSTRUED AS AN ADMISSION OF ANY FACT OR LIABILITY, A STIPULATION OR A WAIVER, AND EACH STATEMENT CONTAINED HEREIN IS MADE WITHOUT PREJUDICE, WITH A FULL RESERVATION OF ALL RIGHTS, REMEDIES, CLAIMS, OR DEFENSES.

31

| Transaction | The Transaction contemplates a restructuring of the Company pursuant to a pre-packaged chapter 11 plan whereby Creditors (as defined below) have the option of receiving their pro rata share of (i) cash from the Cash-Out Option (defined below); and/or (ii) common stock in a new holding company (such common stock, “New Media Common Stock,” and such holding company from and after the Effective Date, “New Media”) with ownership interests in the reorganized Company (such reorganized Company, “New GateHouse”) and the Net Proceeds, if any (as defined below).

New Media intends to distribute a portion of its estimated EBITDA less (i) cash taxes; (ii) interest expense; (iii) principal payments under the Financing, (iv) capital expenditures; and (v) changes in net working capital (“Free Cash Flow”) to its shareholders and reinvest the remainder in accretive acquisitions.

| |

| Outstanding Debt | The Restructuring shall restructure the obligations of the following indebtedness of the Debtors (as defined below) (the “Outstanding Debt”):

(a) Indebtedness under the 2007 Credit Facility, consisting of a “Revolving Credit Facility,” a “Term Loan Facility,” a “Delayed Draw Term Loan Facility” and an “Incremental Term Loan Facility” (collectively, the “2007 Credit Facility Claims”). As of June 30, 2013, the 2007 Credit Facility Claims consisted of a (i) Revolving Credit Facility of $0.00 million, (ii) Term Loan Facility of $654.55 million, (iii) Delayed Draw Term Loan Facility of $244.24 million and (iv) Incremental Term Loan Facility of $268.66 million.

(b) Swap Liability, including (i) $100.00 million notional amount executed February 27, 2007, (ii) $250.00 million notional amount executed April 4, 2007, (iii) $200.00 million notional amount executed April 13, 2007 and (iv) $75.00 million notional amount executed September 18, 2007. As of June 30, 2013, the carrying value of the Swap Liability totaled $31.05 million.

Holders of the Outstanding Debt are referred to herein as “Creditors.”

| |

| Restructuring | The Restructuring contemplates a restructuring of the Outstanding Debt through a pre-packaged chapter 11 plan (the “Plan”), if accepted by the Bankruptcy Threshold Creditors, as follows:

(a) Holders of the Outstanding Debt would receive, in full and final satisfaction of their respective claims, at their election (with respect to all or any portion of their claims) to be made in connection with solicitation of the Plan, their pro rata share of:

i. Cash pursuant to the Cash-Out Offer (described below under “Cash-Out Offer”) (the “Cash-Out Option”); and/or

ii. 100% of New Media Common Stock (subject to dilution as discussed herein) and the Net Proceeds, if any (the “New Media Equity Option”).

Creditors that do not make an election during the Solicitation Period (as defined below) with respect to their claims will be deemed to have elected the Cash-Out Option. |

32

| (b) Pension, trade and all other unsecured claims will be unimpaired by the Plan.

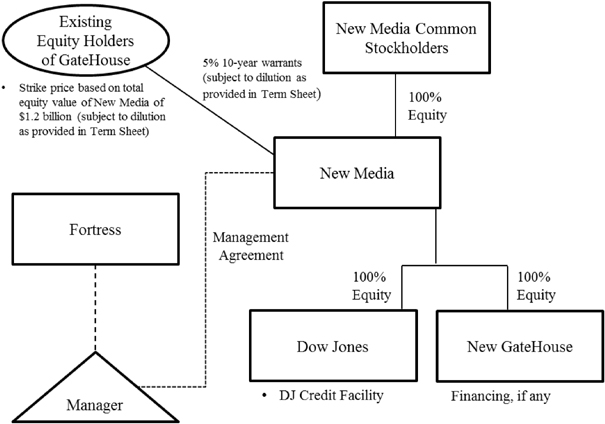

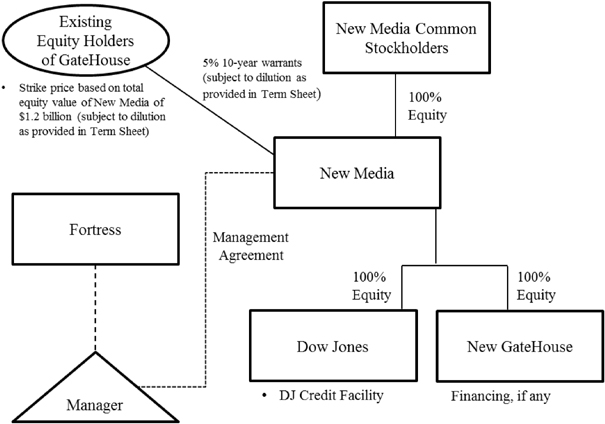

(c) Holders of equity interests, including warrants, rights and options to acquire such equity interests (“Existing Equity Holders” and such equity, the “Existing Equity Interests”), will receive 10-year warrants representing the right to acquire equity equal to 5% of the issued and outstanding shares of New Media (calculated prior to dilution from shares of common stock of New Media issued pursuant to the DJ Contribution (as defined below)) as of the effective date of the Plan (the “Effective Date”), with the strike price for such warrants calculated based on a total equity value of New Media prior to the DJ Contribution of $1.2 billion. Existing Equity Interests will be cancelled under the Plan.

| ||

| Cash-Out Offer | In connection with the Restructuring, Newcastle Investment Corp. (“Plan Sponsor”) will offer to purchase, in cash and at 40.0% of the sum of (i) principal amount of, and accrued and unpaid interest as of the Effective Date on, 2007 Credit Facility Claims and (ii) the carrying value of any Swap Liability, any Outstanding Debt under the 2007 Credit Facility that lenders wish to tender (the “Cash-Out Offer”), which Cash-Out Offer will be coterminous with the Solicitation Period (as defined below).

For the avoidance of doubt, Plan Sponsor will receive its pro rata share of New Media Common Stock and the Net Proceeds, if any, including without limitation, on account of all Outstanding Debt purchased by the Plan Sponsor in the Cash-Out Offer.

| |

| Registration Rights | New Media will enter into a registration rights agreement (the “Registration Rights Agreement”) with Omega Advisors, Inc., and its affiliates, provided that they collectively receive 10% or more (collectively, “Reg Rights Holder”) of New Media Common Stock on the Effective Date, to provide customary registration rights consistent with the Registration Rights Terms attached as Exhibit C.

| |

| Listing | Following the completion of the Restructuring, New Media will use commercially reasonable efforts, based on market conditions and other factors, to list New Media Common Stock (the “Listing”) and may raise additional equity capital in connection with or subsequent to the Listing. New Media intends to seek the Listing on the New York Stock Exchange (“NYSE”).

For the avoidance of doubt, a Listing will not be a condition precedent to the effectiveness of the Plan. Under the Plan, New Media will not impose any transfer restrictions on New Media Common Stock.

| |

| Financing | New GateHouse will use commercially reasonable efforts, based on market conditions and other factors, to raise up to approximately $150 million of new debt, which new debt shall be on the same or better terms for New GateHouse than those set forth in Exhibit D hereto (the “Financing”).

The cash raised in the Financing net of transaction expenses associated with the Restructuring (the “Net Proceeds”), if any, will be distributed on the Effective Date pro rata to holders of New Media Common Stock that received such New Media Common Stock in satisfaction of their Outstanding Debt under the Plan (including, without limitation, to the Plan Sponsor on account of all Outstanding Debt purchased in the Cash-Out Offer).

For the avoidance of doubt, (x) a Financing will not be a condition precedent to the effectiveness of the Plan and (y) Net Proceeds of any Financing will be distributed to holders of New Common Stock prior to the occurrence of the DJ Contribution (as defined below). |

33

| Contribution of Local Media Group Holdings LLC | Subject to Plan Sponsor’s consummation of the acquisition (the “DJ Acquisition”) of Dow Jones Local Media Group, Inc. (“DJLMG”) prior to the Effective Date, Plan Sponsor will contribute Local Media Group Holdings LLC, the 100% owner of DJLMG (“Local Group”) to New Media on the Effective Date (the “DJ Contribution”) in exchange for shares of common stock of New Media equal in value (the “DJ Contribution Value”) to the cost of the DJ Acquisition (as adjusted (a) to include (i) out-of-pocket transaction expenses of the DJ Acquisition not to exceed $4.5 million and (ii) any additional cash equity contributions made in DJLMG or Local Group after the DJ Acquisition not to exceed $2.5 million and (b) to deduct the amount of (i) any dividends paid out by DJLMG or Local Group on or following the closing of the DJ Acquisition and on or prior to the DJ Contribution and (ii) any debt obligations of DJLMG or Local Group (other than amounts drawn under the working capital facility).

The DJ Contribution Value is currently anticipated to be approximately $53.8 million assuming a contribution date of October 31, 2013, consisting of $82.6 million as the estimated cost of the DJ Acquisition, plus (a) (i)$4.2 million in estimated out-of-pocket transaction expenses and (ii) no additional net cash equity contributions, less (b) (i) no dividends paid out by DJLMG or Local Group (other than in respect of amounts contributed by Plan Sponsor on the closing date for working capital purposes) and (ii) $33.0 million in anticipated term loan debt at Local Group; it being understood that Plan Sponsor shall contribute $2.5 million on the closing of the DJ Acquisition for working capital purposes and DJLMG shall repay such amount by dividend or otherwise on the day the revolver becomes available.

For the avoidance of doubt, Plan Sponsor’s obligation to make the DJ Contribution is subject to the occurrence of the DJ Acquisition.

| |

| Solicitation Period | In the event that the Company obtains executed Restructuring Support Agreements from the Requisite Participating Lenders, the Company shall commence a pre-packaged solicitation of the Plan with a voting deadline as provided for under the Restructuring Support Agreement (the “Solicitation Period”), such that the Plan could become effective no later than December 16, 2013 or such later date as provided for under the Restructuring Support Agreement.

| |

| Chapter 11 Cases | Provided that (i) more than 50% in number of the Creditors and (ii) Creditors holding at least 67% of the aggregate amount of the Outstanding Debt, each as necessary for acceptance of a plan of reorganization under the Bankruptcy Code (the thresholds in clauses (i) and (ii) above, the “Bankruptcy Threshold Creditors”), have accepted the Plan during the Solicitation Period and the Restructuring Support Agreement has not terminated, GateHouse and certain of its subsidiaries (upon such filing, the “Debtors”) shall file voluntary petitions for relief under chapter 11 of the Bankruptcy Code commencing chapter 11 cases (the “Chapter 11 Cases”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). The Plan and the disclosure statement describing the Plan (the “Disclosure Statement,” shall be filed contemporaneously with the filing of the Chapter 11 Cases (the “Petition Date”), and shall be in all material respects consistent with the Restructuring Support Agreement.

| |

| Tax/Business Considerations | The parties to the Restructuring Support Agreement shall use good faith efforts to structure the Restructuring and the transactions contemplated thereby and in the Restructuring Support Agreement to the maximum extent possible in a tax-efficient and cost-effective manner for the Company, New Media, the Creditors and the Existing Equity Holders. |

34

| Board Members/Corporate Governance | The corporate governance policies of New Media will be substantially consistent with the Company’s current policies, and will be updated to comply with the requirements of the applicable listing exchange upon the completion of a Listing.

| |

| New Media Management Agreement and Management Incentive Plan | As part of the Restructuring, New Media will enter into a Management Agreement with an affiliate of Plan Sponsor (the “Manager”) pursuant to which the Manager will manage the assets and operations of New Media pursuant to a Management Agreement on terms that are generally consistent with the existing management agreement between Plan Sponsor and an affiliate of Fortress Investment Group LLC. The Manager will provide an array of services, including (i) investment sourcing, underwriting, financial and other structuring advice, (ii) investment acquisition, integration and disposition advice and services with respect to New Media’s assets, and (iii) investor relations services. The annual management fee will be 1.50% of New Media’s gross equity and the Management Agreement will be substantially in the form attached as Exhibit B hereto. Management fees and other compensation as described in the Management Agreement will commence upon the occurrence of the Listing.

Michael Reed, current CEO of GateHouse (the “New Media Employee”), will become an employee of New Media. The Manager will be responsible for the compensation and benefits of the New Media Employee. The New Media Employee’s compensation and benefits shall be subject to the review and approval of the Compensation Committee of the Board of Directors.

A Manager incentive plan will be established for New Media. The terms and conditions of such plan shall be customary for a company of its type.

| |